- India

- /

- Basic Materials

- /

- NSEI:RHIM

It Looks Like The CEO Of RHI Magnesita India Limited (NSE:RHIM) May Be Underpaid Compared To Peers

Shareholders will be pleased by the impressive results for RHI Magnesita India Limited (NSE:RHIM) recently and CEO Parmod Sagar has played a key role. This would be kept in mind at the upcoming AGM on 26 September 2022 which will be a chance for them to hear the board review the financial results, discuss future company strategy and vote on resolutions such as executive remuneration and other matters. We think the CEO has done a pretty decent job and probably deserves a well-earned pay rise.

See our latest analysis for RHI Magnesita India

How Does Total Compensation For Parmod Sagar Compare With Other Companies In The Industry?

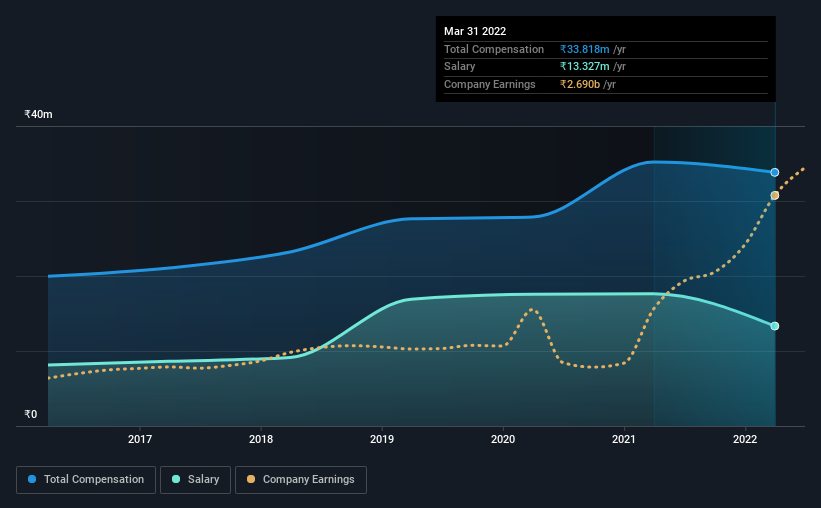

Our data indicates that RHI Magnesita India Limited has a market capitalization of ₹104b, and total annual CEO compensation was reported as ₹34m for the year to March 2022. That's a slight decrease of 3.9% on the prior year. We think total compensation is more important but our data shows that the CEO salary is lower, at ₹13m.

On examining similar-sized companies in the industry with market capitalizations between ₹80b and ₹255b, we discovered that the median CEO total compensation of that group was ₹53m. In other words, RHI Magnesita India pays its CEO lower than the industry median. Moreover, Parmod Sagar also holds ₹8.8m worth of RHI Magnesita India stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | ₹13m | ₹18m | 39% |

| Other | ₹20m | ₹18m | 61% |

| Total Compensation | ₹34m | ₹35m | 100% |

Talking in terms of the industry, salary represented approximately 84% of total compensation out of all the companies we analyzed, while other remuneration made up 16% of the pie. It's interesting to note that RHI Magnesita India allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

RHI Magnesita India Limited's Growth

RHI Magnesita India Limited has seen its earnings per share (EPS) increase by 35% a year over the past three years. Its revenue is up 38% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has RHI Magnesita India Limited Been A Good Investment?

We think that the total shareholder return of 225%, over three years, would leave most RHI Magnesita India Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for RHI Magnesita India that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RHIM

RHI Magnesita India

Engages in the manufacture and trading of refractories, monolithics, bricks, and ceramic paper in India and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives