- India

- /

- Basic Materials

- /

- NSEI:REFRACTORY

Refractory Shapes Limited's (NSE:REFRACTORY) 26% Share Price Plunge Could Signal Some Risk

Unfortunately for some shareholders, the Refractory Shapes Limited (NSE:REFRACTORY) share price has dived 26% in the last thirty days, prolonging recent pain. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

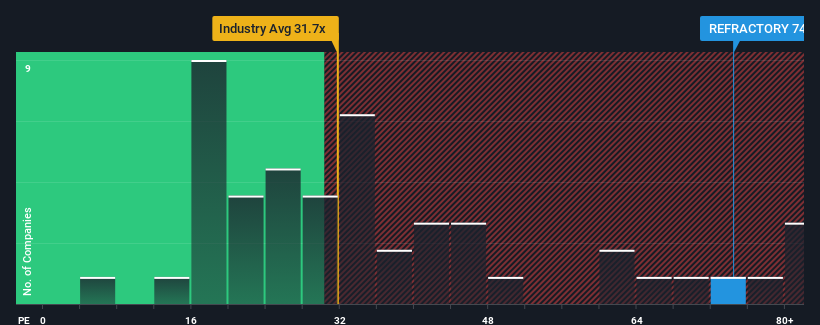

Although its price has dipped substantially, Refractory Shapes may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 74.4x, since almost half of all companies in India have P/E ratios under 34x and even P/E's lower than 19x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been quite advantageous for Refractory Shapes as its earnings have been rising very briskly. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Refractory Shapes

How Is Refractory Shapes' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Refractory Shapes' is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 117%. The latest three year period has also seen an excellent 93% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 26% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

In light of this, it's curious that Refractory Shapes' P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as a continuation of recent earnings trends would weigh down the share price eventually.

What We Can Learn From Refractory Shapes' P/E?

Refractory Shapes' shares may have retreated, but its P/E is still flying high. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Refractory Shapes revealed its three-year earnings trends aren't impacting its high P/E as much as we would have predicted, given they look similar to current market expectations. Right now we are uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 5 warning signs for Refractory Shapes (2 are a bit unpleasant!) that you need to take into consideration.

If you're unsure about the strength of Refractory Shapes' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:REFRACTORY

Refractory Shapes

Produces special shapes, custom made refractory shapes and ceramic balls of low and medium purity in India.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives