Little Excitement Around Pyramid Technoplast Limited's (NSE:PYRAMID) Earnings

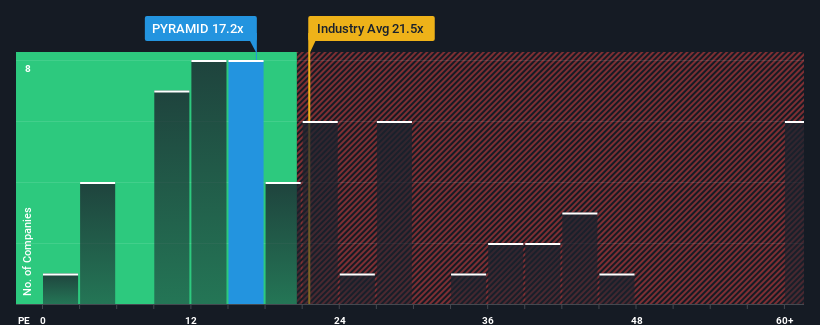

When close to half the companies in India have price-to-earnings ratios (or "P/E's") above 30x, you may consider Pyramid Technoplast Limited (NSE:PYRAMID) as an attractive investment with its 17.2x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For instance, Pyramid Technoplast's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Pyramid Technoplast

How Is Pyramid Technoplast's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Pyramid Technoplast's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 5.3%. Even so, admirably EPS has lifted 52% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 24% shows it's noticeably less attractive on an annualised basis.

In light of this, it's understandable that Pyramid Technoplast's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Pyramid Technoplast maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Pyramid Technoplast that you should be aware of.

You might be able to find a better investment than Pyramid Technoplast. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PYRAMID

Pyramid Technoplast

An industrial packaging company, engages in the manufacture and marketing of polymer-based molded products for chemical, agrochemical, specialty chemical, and pharmaceutical companies for their packaging applications in India.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives