These 4 Measures Indicate That Polyplex (NSE:POLYPLEX) Is Using Debt Safely

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Polyplex Corporation Limited (NSE:POLYPLEX) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Polyplex

How Much Debt Does Polyplex Carry?

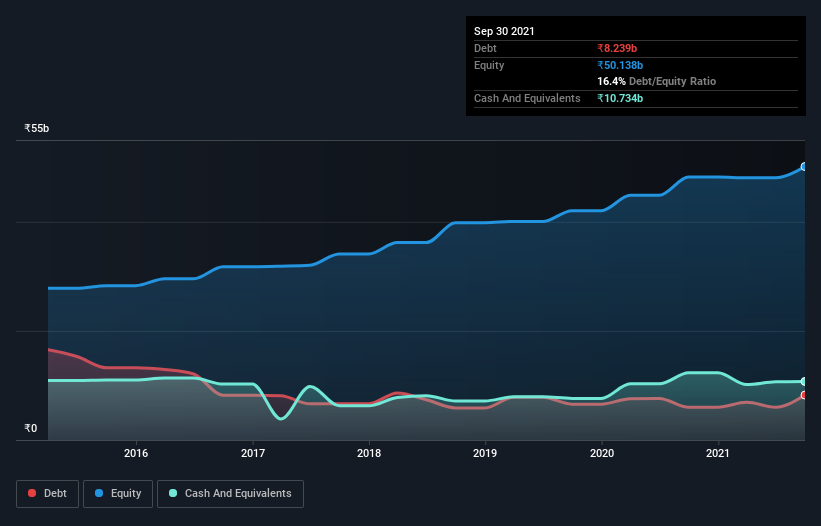

The image below, which you can click on for greater detail, shows that at September 2021 Polyplex had debt of ₹8.24b, up from ₹5.99b in one year. However, it does have ₹10.7b in cash offsetting this, leading to net cash of ₹2.50b.

How Healthy Is Polyplex's Balance Sheet?

We can see from the most recent balance sheet that Polyplex had liabilities of ₹11.5b falling due within a year, and liabilities of ₹5.60b due beyond that. On the other hand, it had cash of ₹10.7b and ₹8.55b worth of receivables due within a year. So it actually has ₹2.19b more liquid assets than total liabilities.

This surplus suggests that Polyplex has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Polyplex has more cash than debt is arguably a good indication that it can manage its debt safely.

Another good sign is that Polyplex has been able to increase its EBIT by 27% in twelve months, making it easier to pay down debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Polyplex can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Polyplex may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Looking at the most recent three years, Polyplex recorded free cash flow of 46% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Polyplex has net cash of ₹2.50b, as well as more liquid assets than liabilities. And we liked the look of last year's 27% year-on-year EBIT growth. So is Polyplex's debt a risk? It doesn't seem so to us. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for Polyplex that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:POLYPLEX

Polyplex

Engages in the manufacture and sale of polymeric films in India, other Asian countries, Europe, the Americas, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.