Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Polyplex Corporation Limited (NSE:POLYPLEX) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Polyplex

What Is Polyplex's Net Debt?

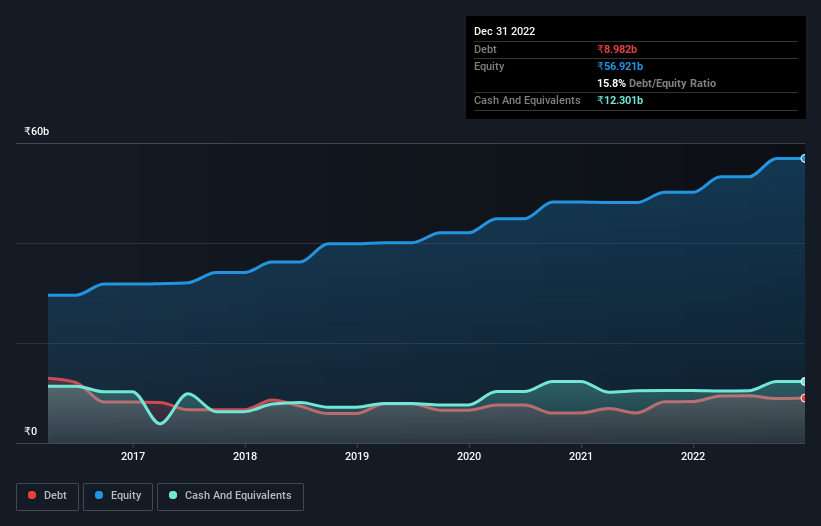

You can click the graphic below for the historical numbers, but it shows that as of September 2022 Polyplex had ₹8.98b of debt, an increase on ₹8.28b, over one year. However, its balance sheet shows it holds ₹12.3b in cash, so it actually has ₹3.32b net cash.

How Strong Is Polyplex's Balance Sheet?

We can see from the most recent balance sheet that Polyplex had liabilities of ₹14.0b falling due within a year, and liabilities of ₹6.01b due beyond that. On the other hand, it had cash of ₹12.3b and ₹11.8b worth of receivables due within a year. So it can boast ₹4.01b more liquid assets than total liabilities.

This surplus suggests that Polyplex has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Polyplex boasts net cash, so it's fair to say it does not have a heavy debt load!

The good news is that Polyplex has increased its EBIT by 6.7% over twelve months, which should ease any concerns about debt repayment. When analysing debt levels, the balance sheet is the obvious place to start. But it is Polyplex's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Polyplex has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, Polyplex's free cash flow amounted to 39% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Polyplex has net cash of ₹3.32b, as well as more liquid assets than liabilities. On top of that, it increased its EBIT by 6.7% in the last twelve months. So we don't think Polyplex's use of debt is risky. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 1 warning sign for Polyplex you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:POLYPLEX

Polyplex

Engages in the manufacture and sale of polymeric films in India, other Asian countries, Europe, the Americas, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Realty Income - A Fundamental and Historical Valuation

A Structured Counter‑Analysis of "The Leaking Dreadnought"

Alphabet Inc. (GOOG): The Gemini Era – Consolidating AI Dominance in 2026.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Nu holdings will continue to disrupt the South American banking market