- India

- /

- Basic Materials

- /

- NSEI:NUVOCO

Nuvoco Vistas Corporation Limited (NSE:NUVOCO) Might Not Be As Mispriced As It Looks

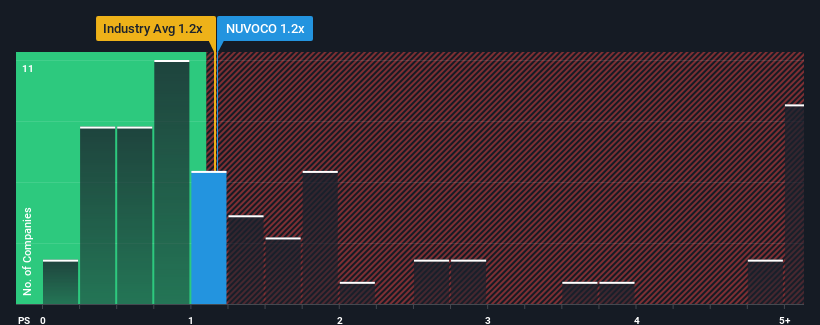

It's not a stretch to say that Nuvoco Vistas Corporation Limited's (NSE:NUVOCO) price-to-sales (or "P/S") ratio of 1.2x seems quite "middle-of-the-road" for Basic Materials companies in India, seeing as it matches the P/S ratio of the wider industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Nuvoco Vistas

How Nuvoco Vistas Has Been Performing

Nuvoco Vistas could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Nuvoco Vistas' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Nuvoco Vistas' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. Pleasingly, revenue has also lifted 56% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 8.6% per year during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 2.1% per year growth forecast for the broader industry.

With this information, we find it interesting that Nuvoco Vistas is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Nuvoco Vistas' P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 3 warning signs for Nuvoco Vistas (1 shouldn't be ignored!) that we have uncovered.

If you're unsure about the strength of Nuvoco Vistas' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Nuvoco Vistas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NUVOCO

Nuvoco Vistas

Manufactures and sale of cement and building materials products in India.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives