Take Care Before Jumping Onto National Fertilizers Limited (NSE:NFL) Even Though It's 25% Cheaper

Unfortunately for some shareholders, the National Fertilizers Limited (NSE:NFL) share price has dived 25% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 23% share price drop.

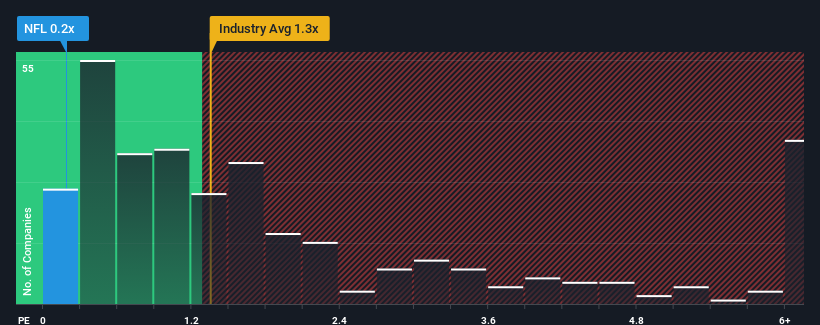

After such a large drop in price, it would be understandable if you think National Fertilizers is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in India's Chemicals industry have P/S ratios above 1.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for National Fertilizers

What Does National Fertilizers' P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at National Fertilizers over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on National Fertilizers will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on National Fertilizers will help you shine a light on its historical performance.How Is National Fertilizers' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like National Fertilizers' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 16%. Still, the latest three year period has seen an excellent 43% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 14% shows it's about the same on an annualised basis.

With this in consideration, we find it intriguing that National Fertilizers' P/S falls short of its industry peers. It may be that most investors are not convinced the company can maintain recent growth rates.

The Final Word

National Fertilizers' recently weak share price has pulled its P/S back below other Chemicals companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of National Fertilizers revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with National Fertilizers (including 1 which shouldn't be ignored).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if National Fertilizers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NFL

National Fertilizers

Engages in the production and marketing of neem coated urea, bio-fertilizers, and other allied Industrial products in India.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives