Nagarjuna Fertilizers and Chemicals Limited (NSE:NAGAFERT) Might Not Be As Mispriced As It Looks After Plunging 26%

Nagarjuna Fertilizers and Chemicals Limited (NSE:NAGAFERT) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 17%.

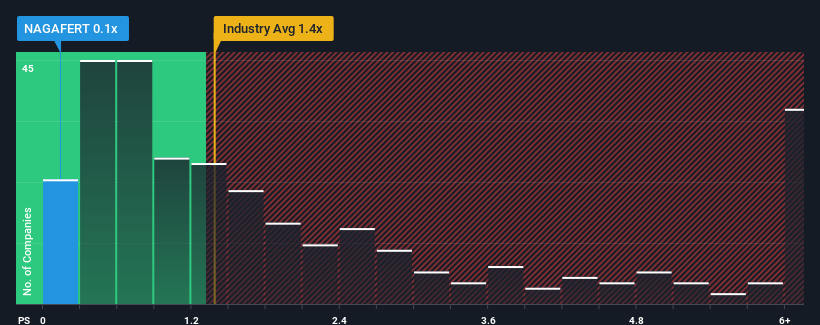

After such a large drop in price, it would be understandable if you think Nagarjuna Fertilizers and Chemicals is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in India's Chemicals industry have P/S ratios above 1.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Nagarjuna Fertilizers and Chemicals

What Does Nagarjuna Fertilizers and Chemicals' P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Nagarjuna Fertilizers and Chemicals over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Nagarjuna Fertilizers and Chemicals, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Nagarjuna Fertilizers and Chemicals?

In order to justify its P/S ratio, Nagarjuna Fertilizers and Chemicals would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 21%. Still, the latest three year period has seen an excellent 177% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 12% shows it's noticeably more attractive.

With this in mind, we find it intriguing that Nagarjuna Fertilizers and Chemicals' P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Nagarjuna Fertilizers and Chemicals' P/S

Nagarjuna Fertilizers and Chemicals' recently weak share price has pulled its P/S back below other Chemicals companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Nagarjuna Fertilizers and Chemicals currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Nagarjuna Fertilizers and Chemicals (2 are a bit unpleasant!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Nagarjuna Fertilizers and Chemicals, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Nagarjuna Fertilizers and Chemicals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NAGAFERT

Nagarjuna Fertilizers and Chemicals

Manufactures and markets fertilizers and micro irrigation equipment in India.

Slight risk with weak fundamentals.

Market Insights

Community Narratives