- India

- /

- Metals and Mining

- /

- NSEI:MANAKCOAT

Here's Why I Think Manaksia Coated Metals & Industries (NSE:MANAKCOAT) Might Deserve Your Attention Today

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Manaksia Coated Metals & Industries (NSE:MANAKCOAT). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Manaksia Coated Metals & Industries

Manaksia Coated Metals & Industries's Improving Profits

In the last three years Manaksia Coated Metals & Industries's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Manaksia Coated Metals & Industries boosted its trailing twelve month EPS from ₹0.90 to ₹1.02, in the last year. That's a 14% gain; respectable growth in the broader scheme of things.

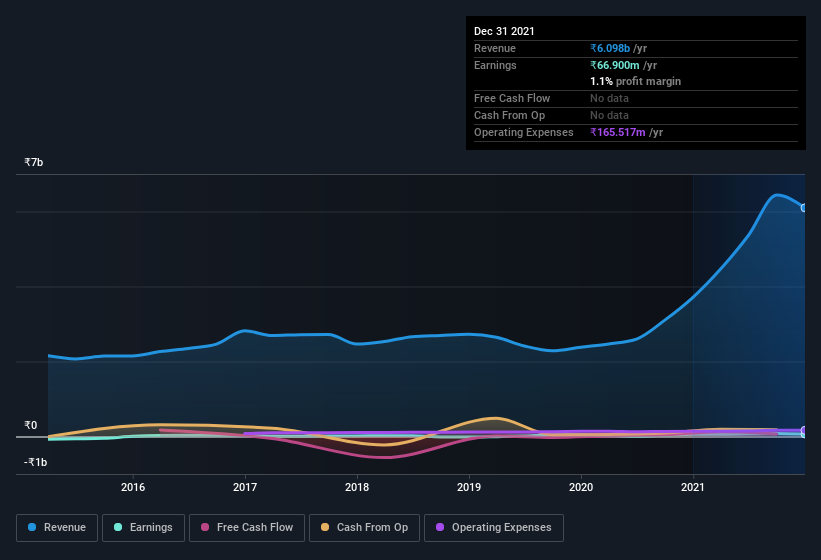

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Manaksia Coated Metals & Industries maintained stable EBIT margins over the last year, all while growing revenue 64% to ₹6.1b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Manaksia Coated Metals & Industries is no giant, with a market capitalization of ₹2.0b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Manaksia Coated Metals & Industries Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for Manaksia Coated Metals & Industries shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Kanta Agrawal, the of the company, paid ₹1.9m for shares at around ₹12.95 each.

On top of the insider buying, we can also see that Manaksia Coated Metals & Industries insiders own a large chunk of the company. In fact, they own 72% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about ₹1.4b riding on the stock, at current prices. That's nothing to sneeze at!

Is Manaksia Coated Metals & Industries Worth Keeping An Eye On?

One positive for Manaksia Coated Metals & Industries is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. It is worth noting though that we have found 3 warning signs for Manaksia Coated Metals & Industries (1 is a bit unpleasant!) that you need to take into consideration.

As a growth investor I do like to see insider buying. But Manaksia Coated Metals & Industries isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MANAKCOAT

Manaksia Coated Metals & Industries

Manufactures and sells coated metal products in India and internationally.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026