- India

- /

- Metals and Mining

- /

- NSEI:MAITHANALL

Maithan Alloys (NSE:MAITHANALL) Has Affirmed Its Dividend Of ₹6.00

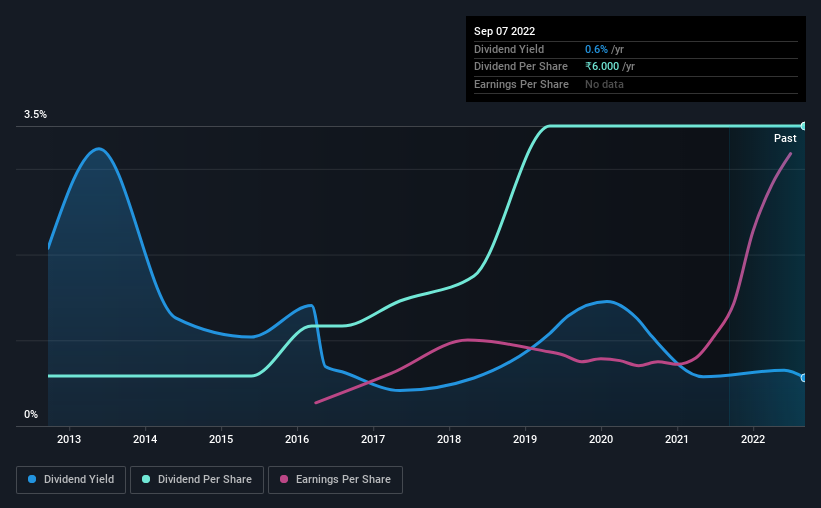

Maithan Alloys Limited's (NSE:MAITHANALL) investors are due to receive a payment of ₹6.00 per share on 28th of October. Including this payment, the dividend yield on the stock will be 0.6%, which is a modest boost for shareholders' returns.

View our latest analysis for Maithan Alloys

Maithan Alloys' Payment Has Solid Earnings Coverage

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. However, Maithan Alloys' earnings easily cover the dividend. This means that most of its earnings are being retained to grow the business.

Looking forward, earnings per share could rise by 38.8% over the next year if the trend from the last few years continues. If the dividend continues along recent trends, we estimate the payout ratio will be 1.5%, which is in the range that makes us comfortable with the sustainability of the dividend.

Maithan Alloys Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. Since 2012, the dividend has gone from ₹1.00 total annually to ₹6.00. This works out to be a compound annual growth rate (CAGR) of approximately 20% a year over that time. Rapidly growing dividends for a long time is a very valuable feature for an income stock.

The Dividend Looks Likely To Grow

The company's investors will be pleased to have been receiving dividend income for some time. Maithan Alloys has seen EPS rising for the last five years, at 39% per annum. A low payout ratio gives the company a lot of flexibility, and growing earnings also make it very easy for it to grow the dividend.

We Really Like Maithan Alloys' Dividend

Overall, we like to see the dividend staying consistent, and we think Maithan Alloys might even raise payments in the future. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All in all, this checks a lot of the boxes we look for when choosing an income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Are management backing themselves to deliver performance? Check their shareholdings in Maithan Alloys in our latest insider ownership analysis. Is Maithan Alloys not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MAITHANALL

Established dividend payer with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026