3 Stocks On The Indian Exchange Estimated To Be Below Their Intrinsic Value

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has experienced a 4.9% decline, yet it remains up by 37% over the past year with earnings projected to grow by 18% annually in the coming years. In this fluctuating environment, identifying stocks that are estimated to be below their intrinsic value can offer potential opportunities for investors seeking long-term growth.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Everest Kanto Cylinder (NSEI:EKC) | ₹172.69 | ₹310.79 | 44.4% |

| Sudarshan Chemical Industries (BSE:506655) | ₹942.70 | ₹1830.04 | 48.5% |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1146.40 | ₹2152.54 | 46.7% |

| RITES (NSEI:RITES) | ₹277.85 | ₹519.25 | 46.5% |

| Jindal Steel & Power (NSEI:JINDALSTEL) | ₹899.05 | ₹1531.31 | 41.3% |

| Orchid Pharma (NSEI:ORCHPHARMA) | ₹1254.75 | ₹2142.32 | 41.4% |

| Vedanta (NSEI:VEDL) | ₹455.40 | ₹891.32 | 48.9% |

| Patel Engineering (BSE:531120) | ₹47.66 | ₹89.73 | 46.9% |

| IRB Infrastructure Developers (NSEI:IRB) | ₹50.79 | ₹89.00 | 42.9% |

| Tarsons Products (NSEI:TARSONS) | ₹406.65 | ₹711.26 | 42.8% |

Underneath we present a selection of stocks filtered out by our screen.

Krsnaa Diagnostics (NSEI:KRSNAA)

Overview: Krsnaa Diagnostics Limited offers diagnostic services in India and has a market cap of ₹25.32 billion.

Operations: The company's revenue primarily comes from its Radiology and Pathology Services segment, which generated ₹6.81 billion.

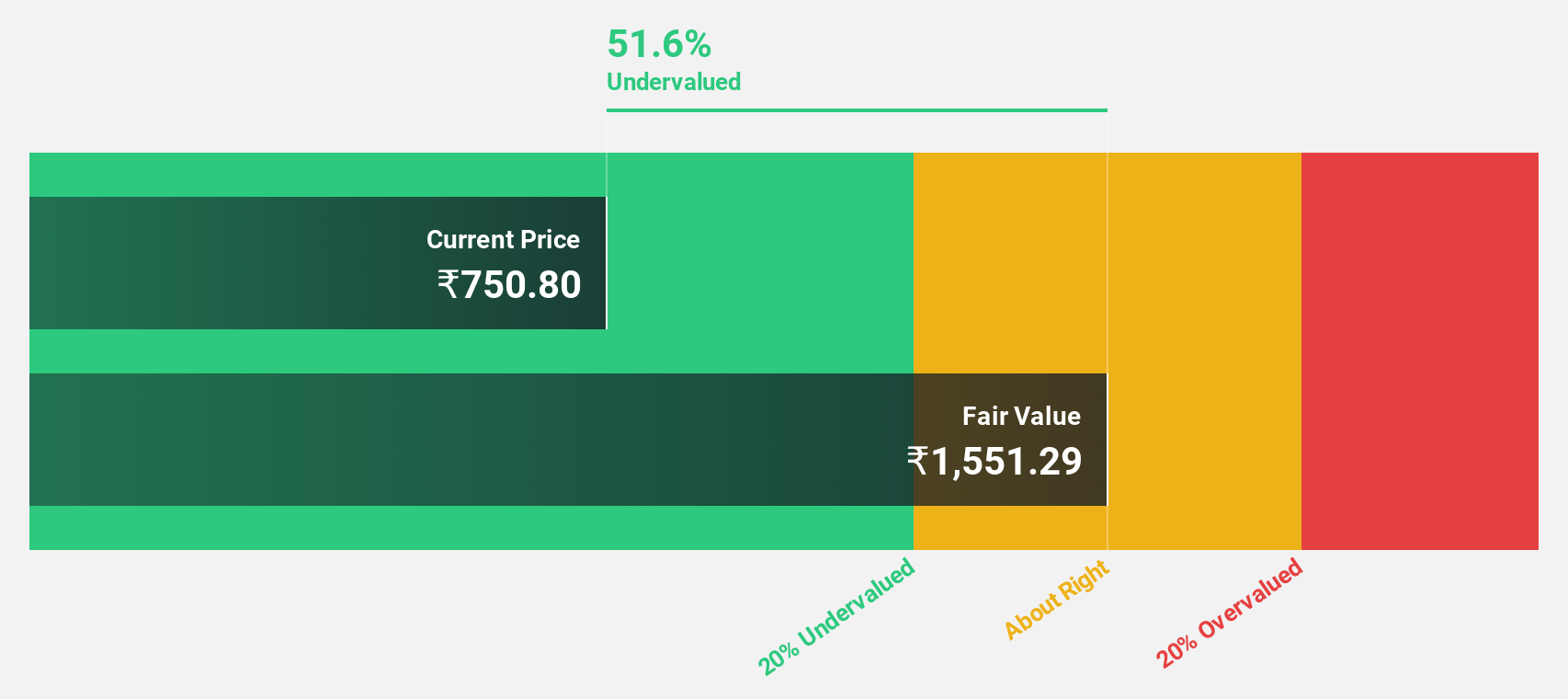

Estimated Discount To Fair Value: 32.7%

Krsnaa Diagnostics is trading at ₹784.1, significantly below its estimated fair value of ₹1165.33, suggesting potential undervaluation based on cash flows. The company has demonstrated strong revenue growth, with recent quarterly sales increasing to ₹1.86 billion from ₹1.55 billion a year ago and net income rising to ₹195.96 million from ₹104.96 million in the same period last year. However, past shareholder dilution and low dividend coverage by free cash flows are notable concerns.

- Upon reviewing our latest growth report, Krsnaa Diagnostics' projected financial performance appears quite optimistic.

- Dive into the specifics of Krsnaa Diagnostics here with our thorough financial health report.

Laxmi Organic Industries (NSEI:LXCHEM)

Overview: Laxmi Organic Industries Limited is engaged in the production of acetyl and specialty intermediate products, serving both domestic and international markets, with a market cap of ₹67.47 billion.

Operations: The company's revenue is primarily derived from its Chemicals Business segment, which generated ₹28.54 billion.

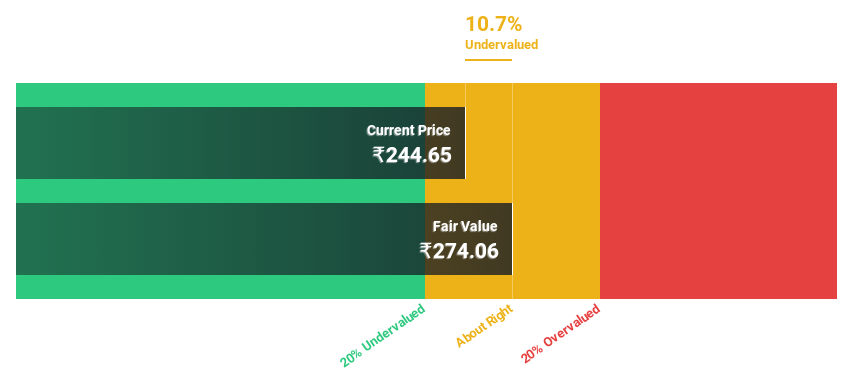

Estimated Discount To Fair Value: 10.7%

Laxmi Organic Industries, priced at ₹244.65, is trading below its fair value estimate of ₹274.06, indicating it may be undervalued based on cash flows. The company's earnings are projected to grow significantly at 28.8% annually over the next three years, outpacing the Indian market's growth rate of 17.6%. However, a recent regulatory order demands ₹235.2 million plus penalties for disallowed ITC credits, which could impact financial stability if not resolved favorably.

- Our expertly prepared growth report on Laxmi Organic Industries implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Laxmi Organic Industries.

Mindspace Business Parks REIT (NSEI:MINDSPACE)

Overview: Mindspace Business Parks REIT, sponsored by K Raheja Corp group and listed on the Indian bourses in August 2020, operates as a real estate investment trust focusing on office spaces with a market cap of ₹217.01 billion.

Operations: The company's revenue is primarily derived from Real Estate, contributing ₹23.88 billion, and Power Distribution, adding ₹1.33 billion.

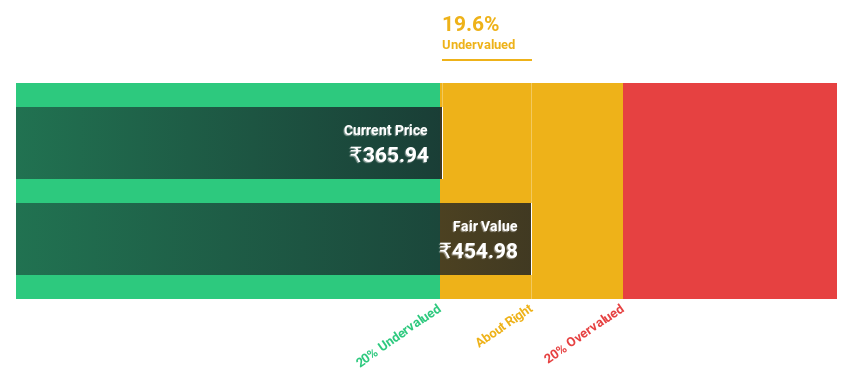

Estimated Discount To Fair Value: 19.6%

Mindspace Business Parks REIT, trading at ₹365.94, is below its estimated fair value of ₹454.98, suggesting potential undervaluation based on cash flows. Despite a decline in recent quarterly net income to INR 1,256.27 million from INR 1,411.65 million year-over-year, earnings are forecasted to grow significantly at 21.22% annually over the next three years. However, interest payments remain inadequately covered by earnings and the dividend track record is unstable, which could pose risks to financial health.

- According our earnings growth report, there's an indication that Mindspace Business Parks REIT might be ready to expand.

- Click to explore a detailed breakdown of our findings in Mindspace Business Parks REIT's balance sheet health report.

Seize The Opportunity

- Dive into all 32 of the Undervalued Indian Stocks Based On Cash Flows we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:LXCHEM

Laxmi Organic Industries

Provides acetyl and specialty intermediate products in India and internationally.

Flawless balance sheet with reasonable growth potential.