Krishana Phoschem's (NSE:KRISHANA) Solid Profits Have Weak Fundamentals

Last week's profit announcement from Krishana Phoschem Limited (NSE:KRISHANA) was underwhelming for investors, despite headline numbers being robust. We think that the market might be paying attention to some underlying factors are concerning.

Check out our latest analysis for Krishana Phoschem

Zooming In On Krishana Phoschem's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

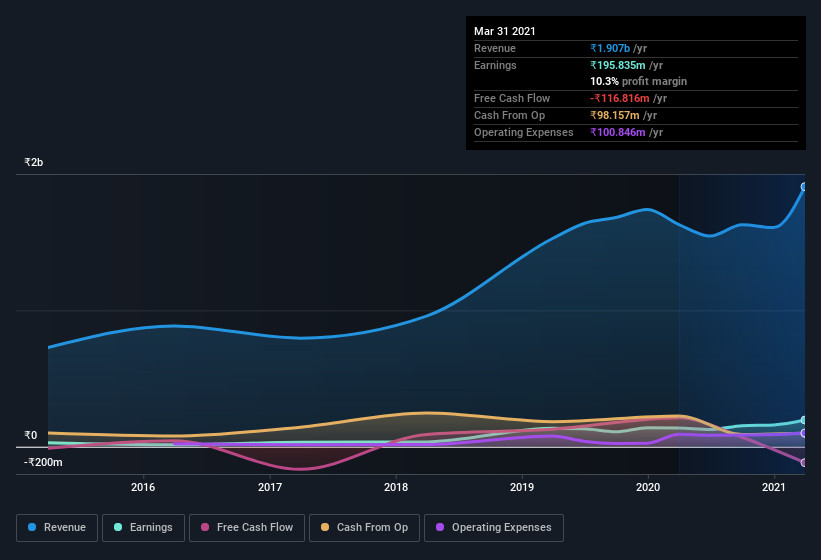

Over the twelve months to March 2021, Krishana Phoschem recorded an accrual ratio of 0.21. We can therefore deduce that its free cash flow fell well short of covering its statutory profit. In the last twelve months it actually had negative free cash flow, with an outflow of ₹117m despite its profit of ₹195.8m, mentioned above. We saw that FCF was ₹213m a year ago though, so Krishana Phoschem has at least been able to generate positive FCF in the past. Unfortunately for shareholders, the company has also been issuing new shares, diluting their share of future earnings. The good news for shareholders is that Krishana Phoschem's accrual ratio was much better last year, so this year's poor reading might simply be a case of a short term mismatch between profit and FCF. As a result, some shareholders may be looking for stronger cash conversion in the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Krishana Phoschem.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, Krishana Phoschem issued 10% more new shares over the last year. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Krishana Phoschem's EPS by clicking here.

How Is Dilution Impacting Krishana Phoschem's Earnings Per Share? (EPS)

Krishana Phoschem has improved its profit over the last three years, with an annualized gain of 449% in that time. And the 42% profit boost in the last year certainly seems impressive at first glance. But in comparison, EPS only increased by 42% over the same period. And so, you can see quite clearly that dilution is influencing shareholder earnings.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So Krishana Phoschem shareholders will want to see that EPS figure continue to increase. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Krishana Phoschem's Profit Performance

As it turns out, Krishana Phoschem couldn't match its profit with cashflow and its dilution means that earnings per share growth is lagging net income growth. For the reasons mentioned above, we think that a perfunctory glance at Krishana Phoschem's statutory profits might make it look better than it really is on an underlying level. So while earnings quality is important, it's equally important to consider the risks facing Krishana Phoschem at this point in time. For example, we've found that Krishana Phoschem has 5 warning signs (1 is a bit unpleasant!) that deserve your attention before going any further with your analysis.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Krishana Phoschem or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Krishana Phoschem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:KRISHANA

Krishana Phoschem

Engages in the manufacture and sale of fertilizers and chemicals under the Annadata and Bharat brands in India.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives