There's Reason For Concern Over Kamdhenu Ventures Limited's (NSE:KAMOPAINTS) Massive 29% Price Jump

The Kamdhenu Ventures Limited (NSE:KAMOPAINTS) share price has done very well over the last month, posting an excellent gain of 29%. The annual gain comes to 178% following the latest surge, making investors sit up and take notice.

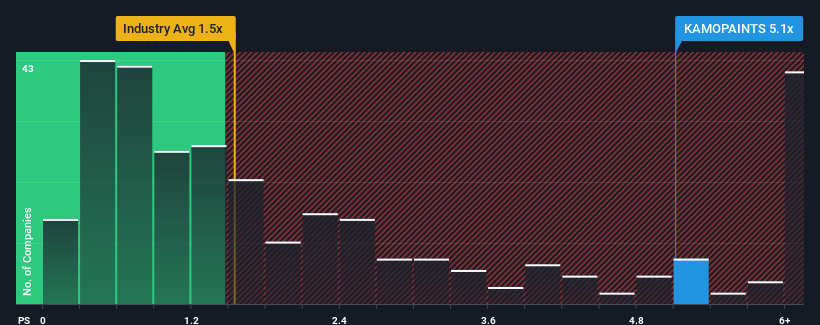

After such a large jump in price, given around half the companies in India's Chemicals industry have price-to-sales ratios (or "P/S") below 1.5x, you may consider Kamdhenu Ventures as a stock to avoid entirely with its 5.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Kamdhenu Ventures

How Has Kamdhenu Ventures Performed Recently?

Recent times have been quite advantageous for Kamdhenu Ventures as its revenue has been rising very briskly. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Kamdhenu Ventures' earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Kamdhenu Ventures?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Kamdhenu Ventures' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 47% gain to the company's top line. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 11% shows it's noticeably less attractive.

In light of this, it's alarming that Kamdhenu Ventures' P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Kamdhenu Ventures' P/S Mean For Investors?

The strong share price surge has lead to Kamdhenu Ventures' P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Kamdhenu Ventures currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Kamdhenu Ventures, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Kamdhenu Ventures, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kamdhenu Ventures might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KAMOPAINTS

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives