- India

- /

- Metals and Mining

- /

- NSEI:KAMDHENU

Kamdhenu Limited (NSE:KAMDHENU) Stock Catapults 27% Though Its Price And Business Still Lag The Market

Kamdhenu Limited (NSE:KAMDHENU) shareholders have had their patience rewarded with a 27% share price jump in the last month. Notwithstanding the latest gain, the annual share price return of 9.3% isn't as impressive.

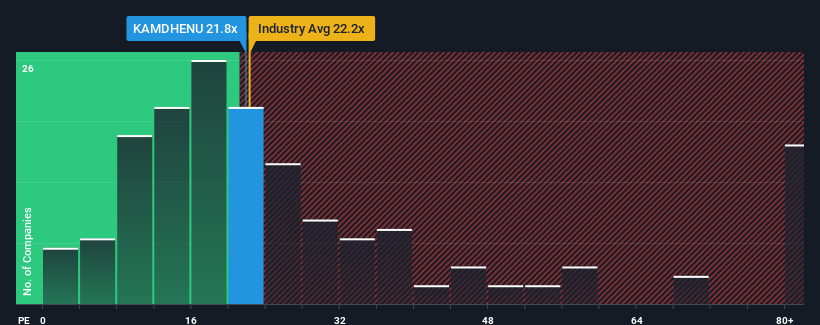

In spite of the firm bounce in price, Kamdhenu's price-to-earnings (or "P/E") ratio of 21.8x might still make it look like a buy right now compared to the market in India, where around half of the companies have P/E ratios above 30x and even P/E's above 56x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been quite advantageous for Kamdhenu as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Kamdhenu

Is There Any Growth For Kamdhenu?

In order to justify its P/E ratio, Kamdhenu would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 44% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 26% shows it's noticeably less attractive on an annualised basis.

In light of this, it's understandable that Kamdhenu's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Bottom Line On Kamdhenu's P/E

Despite Kamdhenu's shares building up a head of steam, its P/E still lags most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Kamdhenu maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Kamdhenu that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Kamdhenu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KAMDHENU

Kamdhenu

Manufactures, markets, and distributes thermo mechanical treatment (TMT) bars, structural steel, and allied products under the Kamdhenu brand name in India.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives