- India

- /

- Professional Services

- /

- NSEI:QUESS

3 Undervalued Indian Stocks With Estimated Discounts Up To 25.2%

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped 1.1%, driven by pullbacks in the Financials and Energy sectors of 2.1% and 5.2%, respectively, although it is up 40% over the past year with earnings forecast to grow by 17% annually. In this context, identifying undervalued stocks can provide opportunities for investors to capitalize on potential growth at discounted prices.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Everest Kanto Cylinder (NSEI:EKC) | ₹184.15 | ₹306.29 | 39.9% |

| Prataap Snacks (NSEI:DIAMONDYD) | ₹815.10 | ₹1509.79 | 46% |

| Venus Pipes and Tubes (NSEI:VENUSPIPES) | ₹2331.65 | ₹4436.62 | 47.4% |

| Apollo Pipes (BSE:531761) | ₹633.20 | ₹1151.35 | 45% |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1343.70 | ₹2181.22 | 38.4% |

| RITES (NSEI:RITES) | ₹681.40 | ₹1037.92 | 34.3% |

| Patel Engineering (BSE:531120) | ₹57.24 | ₹93.66 | 38.9% |

| Artemis Medicare Services (NSEI:ARTEMISMED) | ₹284.55 | ₹445.15 | 36.1% |

| IRB Infrastructure Developers (NSEI:IRB) | ₹60.05 | ₹93.38 | 35.7% |

| Tarsons Products (NSEI:TARSONS) | ₹444.35 | ₹709.92 | 37.4% |

We'll examine a selection from our screener results.

Jindal Steel & Power (NSEI:JINDALSTEL)

Overview: Jindal Steel & Power Limited operates in the steel, mining, and infrastructure sectors in India and internationally, with a market cap of ₹986.32 billion.

Operations: The company's revenue primarily comes from manufacturing steel products, amounting to ₹510.56 billion.

Estimated Discount To Fair Value: 18.2%

Jindal Steel & Power, trading at ₹1004.65, is undervalued based on its discounted cash flow analysis with a fair value estimate of ₹1228.72. The company’s earnings are forecast to grow 24% annually, outpacing the Indian market's 17.1%. Despite significant insider selling in the past three months and lower-than-expected Q1 net income (₹13.40 billion), it remains attractive due to its strong revenue growth and good relative value compared to peers and industry standards.

- The analysis detailed in our Jindal Steel & Power growth report hints at robust future financial performance.

- Get an in-depth perspective on Jindal Steel & Power's balance sheet by reading our health report here.

Piramal Pharma (NSEI:PPLPHARMA)

Overview: Piramal Pharma Limited is a pharmaceutical company with operations in North America, Europe, Japan, India, and internationally, and has a market cap of ₹308.46 billion.

Operations: The company generates revenue of ₹83.73 billion from its pharmaceutical segment.

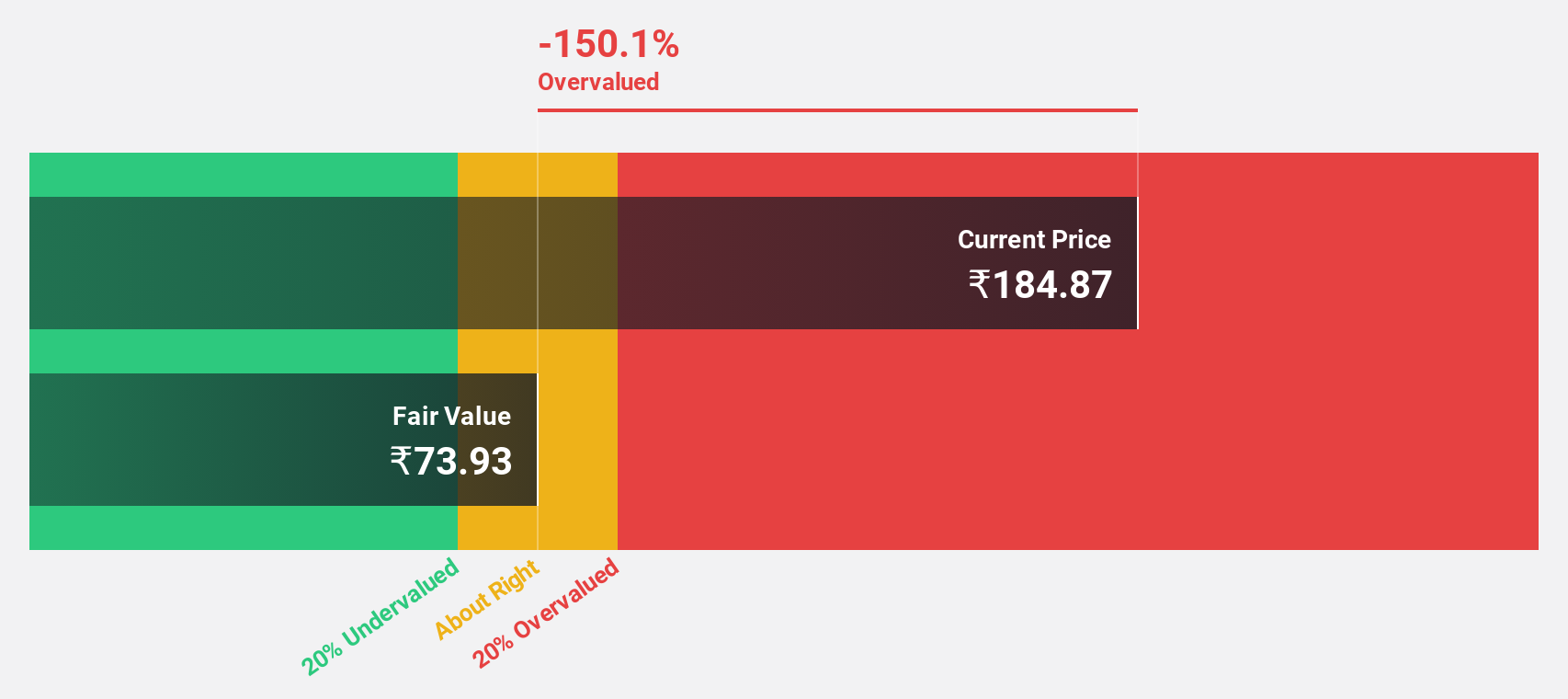

Estimated Discount To Fair Value: 19.6%

Piramal Pharma, trading at ₹232.67, is undervalued based on its discounted cash flow analysis with a fair value estimate of ₹289.56. Despite recent regulatory penalties and a net loss of ₹886.4 million in Q1 2024, the company's earnings are forecast to grow significantly at 73.5% per year over the next three years, outpacing the Indian market's growth rate of 17.1%. Revenue also increased to ₹19.71 billion from ₹17.87 billion year-over-year.

- Our growth report here indicates Piramal Pharma may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Piramal Pharma.

Quess (NSEI:QUESS)

Overview: Quess Corp Limited operates as a business services provider in India, South East Asia, the Middle East, and North America with a market cap of ₹119.38 billion.

Operations: The company's revenue segments include Product Led Business at ₹4.29 billion, Workforce Management at ₹138.44 billion, Operating Asset Management at ₹28.43 billion, and Global Technology Solutions (excluding Product Led Business) at ₹23.87 billion.

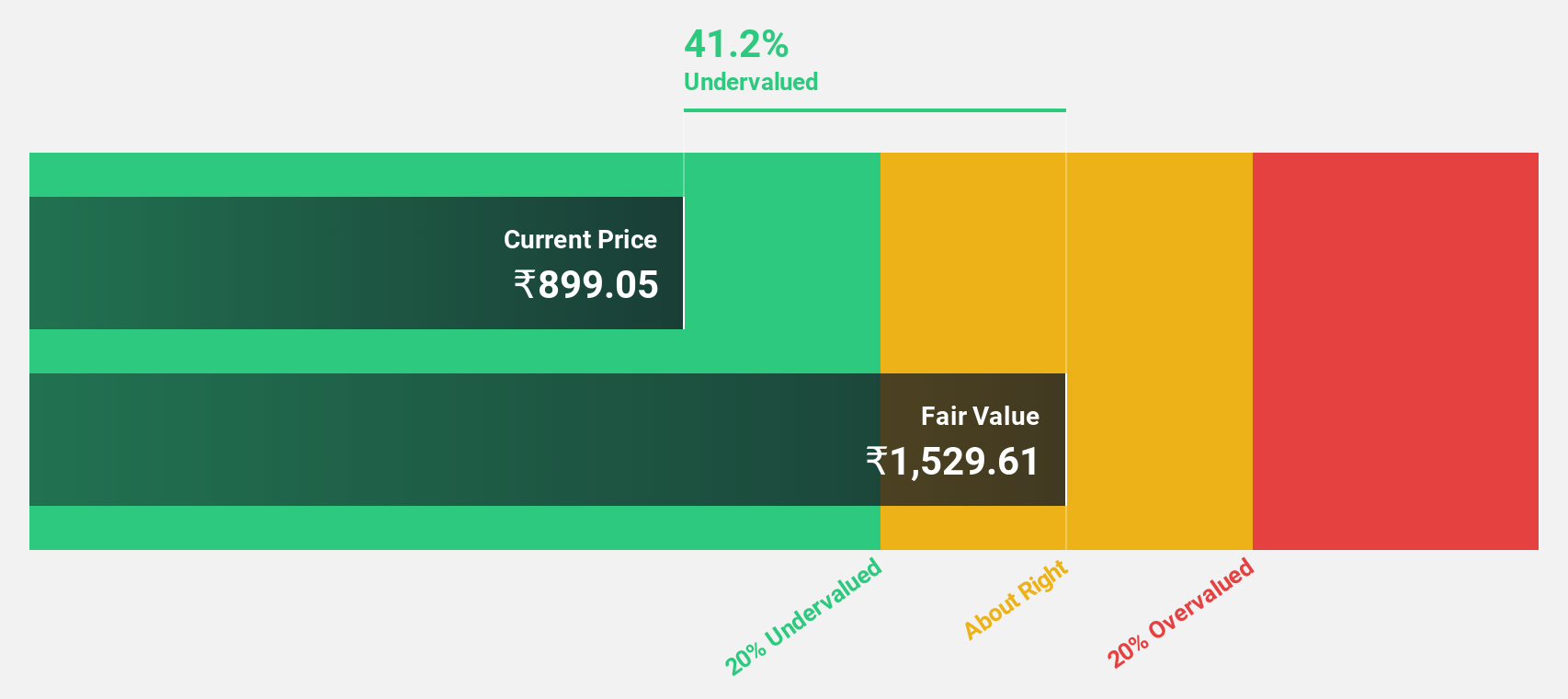

Estimated Discount To Fair Value: 25.2%

Quess Corp Limited, trading at ₹803.2, is undervalued with a fair value estimate of ₹1073.58 based on discounted cash flow analysis. The company's earnings grew by 62.5% over the past year and are forecast to grow significantly at 22.84% annually over the next three years, outpacing the Indian market's 17.1%. Despite an unstable dividend track record, Quess reported strong Q1 results with net income of ₹1.04 billion and revenue of ₹50.13 billion.

- Insights from our recent growth report point to a promising forecast for Quess' business outlook.

- Navigate through the intricacies of Quess with our comprehensive financial health report here.

Taking Advantage

- Delve into our full catalog of 27 Undervalued Indian Stocks Based On Cash Flows here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quess might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:QUESS

Quess

Provides staffing and workforce solutions in India and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives