- India

- /

- Metals and Mining

- /

- NSEI:INCREDIBLE

Incredible Industries (NSE:INCREDIBLE) Will Want To Turn Around Its Return Trends

What trends should we look for it we want to identify stocks that can multiply in value over the long term? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. However, after investigating Incredible Industries (NSE:INCREDIBLE), we don't think it's current trends fit the mold of a multi-bagger.

What is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Incredible Industries:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.055 = ₹85m ÷ (₹1.9b - ₹417m) (Based on the trailing twelve months to December 2021).

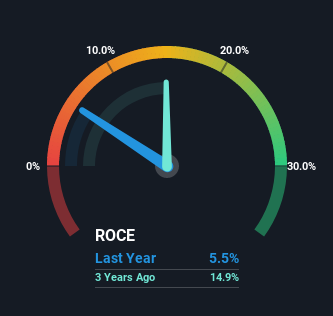

So, Incredible Industries has an ROCE of 5.5%. In absolute terms, that's a low return and it also under-performs the Metals and Mining industry average of 18%.

Check out our latest analysis for Incredible Industries

Historical performance is a great place to start when researching a stock so above you can see the gauge for Incredible Industries' ROCE against it's prior returns. If you're interested in investigating Incredible Industries' past further, check out this free graph of past earnings, revenue and cash flow.

So How Is Incredible Industries' ROCE Trending?

In terms of Incredible Industries' historical ROCE movements, the trend isn't fantastic. Around five years ago the returns on capital were 16%, but since then they've fallen to 5.5%. Although, given both revenue and the amount of assets employed in the business have increased, it could suggest the company is investing in growth, and the extra capital has led to a short-term reduction in ROCE. If these investments prove successful, this can bode very well for long term stock performance.

On a related note, Incredible Industries has decreased its current liabilities to 21% of total assets. That could partly explain why the ROCE has dropped. What's more, this can reduce some aspects of risk to the business because now the company's suppliers or short-term creditors are funding less of its operations. Some would claim this reduces the business' efficiency at generating ROCE since it is now funding more of the operations with its own money.

The Key Takeaway

While returns have fallen for Incredible Industries in recent times, we're encouraged to see that sales are growing and that the business is reinvesting in its operations. But since the stock has dived 81% in the last five years, there could be other drivers that are influencing the business' outlook. Regardless, reinvestment can pay off in the long run, so we think astute investors may want to look further into this stock.

Incredible Industries does come with some risks though, we found 3 warning signs in our investment analysis, and 1 of those is significant...

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INCREDIBLE

Incredible Industries

Manufactures and sells iron and steel products in India.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives