Optimistic Investors Push Hindprakash Industries Limited (NSE:HPIL) Shares Up 28% But Growth Is Lacking

The Hindprakash Industries Limited (NSE:HPIL) share price has done very well over the last month, posting an excellent gain of 28%. The last 30 days bring the annual gain to a very sharp 46%.

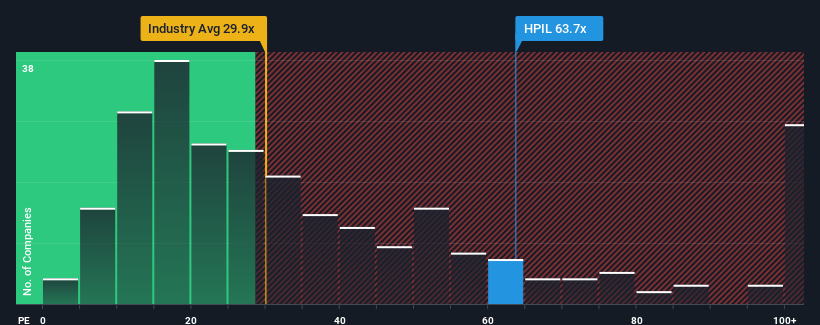

After such a large jump in price, Hindprakash Industries may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 63.7x, since almost half of all companies in India have P/E ratios under 30x and even P/E's lower than 17x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

The earnings growth achieved at Hindprakash Industries over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Hindprakash Industries

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Hindprakash Industries' is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 15% gain to the company's bottom line. As a result, it also grew EPS by 14% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Hindprakash Industries is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Hindprakash Industries' P/E?

Shares in Hindprakash Industries have built up some good momentum lately, which has really inflated its P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Hindprakash Industries currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Hindprakash Industries (at least 1 which is a bit unpleasant), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Hindprakash Industries, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hindprakash Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HPIL

Hindprakash Industries

Manufactures and trades in dyes, auxiliaries, intermediates, and chemicals in India and internationally.

Proven track record with low risk.

Market Insights

Community Narratives