July 2024 Insight Into Three Indian Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

In the past year, India's market has experienced a significant upswing, rising by 45%, though it remained flat over the last week. With earnings expected to grow by 16% annually, growth companies with high insider ownership could be particularly appealing as they often indicate confidence from those most familiar with the company's inner workings.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

| Pitti Engineering (BSE:513519) | 30.3% | 28.0% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 29.8% |

| Shivalik Bimetal Controls (BSE:513097) | 19.5% | 28.7% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.2% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 34.5% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| JNK India (NSEI:JNKINDIA) | 23.8% | 31.8% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 26.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Hi-Tech Pipes (NSEI:HITECH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hi-Tech Pipes Limited is an Indian company that produces steel products for various sectors including infrastructure, construction, automobiles, energy, agriculture, defense, engineering, and telecom; it has a market capitalization of approximately ₹24.52 billion.

Operations: The company's revenue from manufacturing steel pipes and CR products totals approximately ₹26.99 billion.

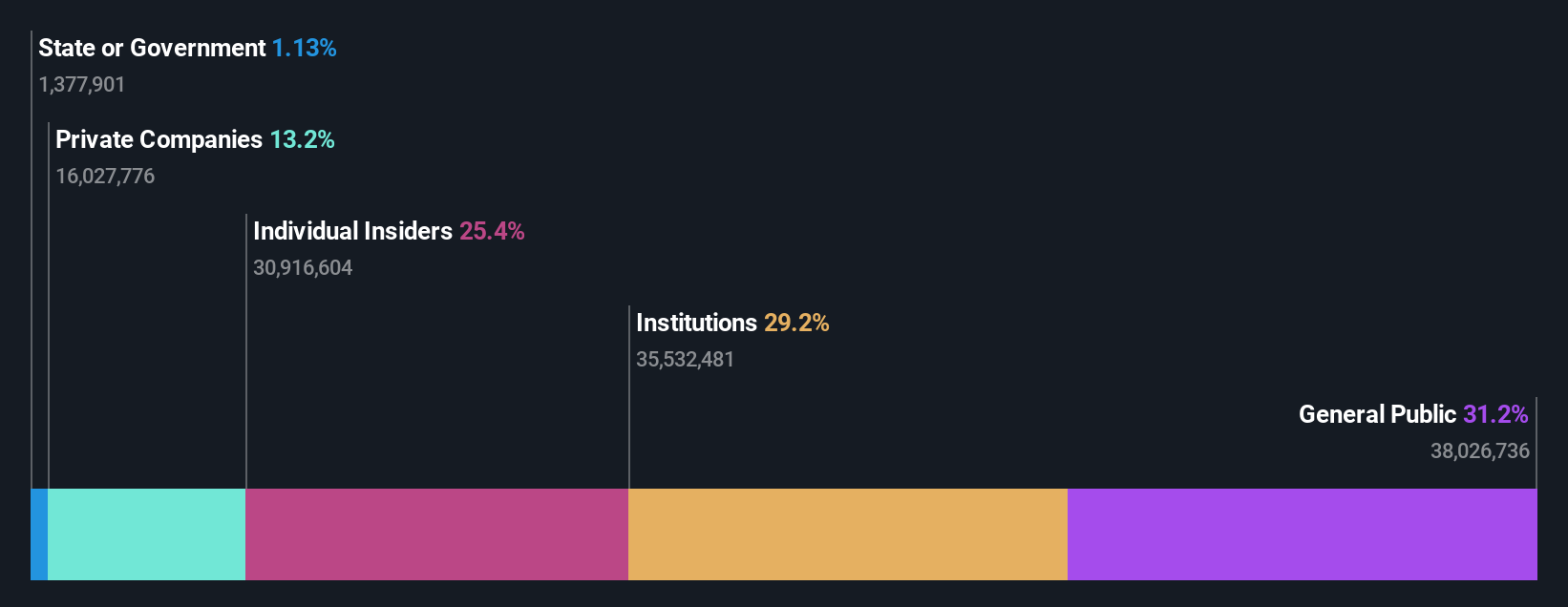

Insider Ownership: 39%

Revenue Growth Forecast: 25.3% p.a.

Hi-Tech Pipes, despite its recent dip in quarterly net income and earnings per share, shows robust growth prospects with forecasted annual earnings growth significantly outpacing the Indian market. The company has not seen substantial insider selling in the past three months, indicating continued confidence among insiders. However, concerns arise as interest payments are poorly covered by earnings and shareholders have experienced dilution over the past year. This mixed financial health is crucial for investors focusing on growth companies with high insider ownership in India.

- Get an in-depth perspective on Hi-Tech Pipes' performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Hi-Tech Pipes implies its share price may be too high.

MTAR Technologies (NSEI:MTARTECH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MTAR Technologies Limited is a precision engineering solutions company that develops, manufactures, and sells mission-critical precision assemblies and components both in India and internationally, with a market capitalization of ₹60.74 billion.

Operations: The company generates ₹5.81 billion from manufacturing high precision and heavy equipment, components, and machines.

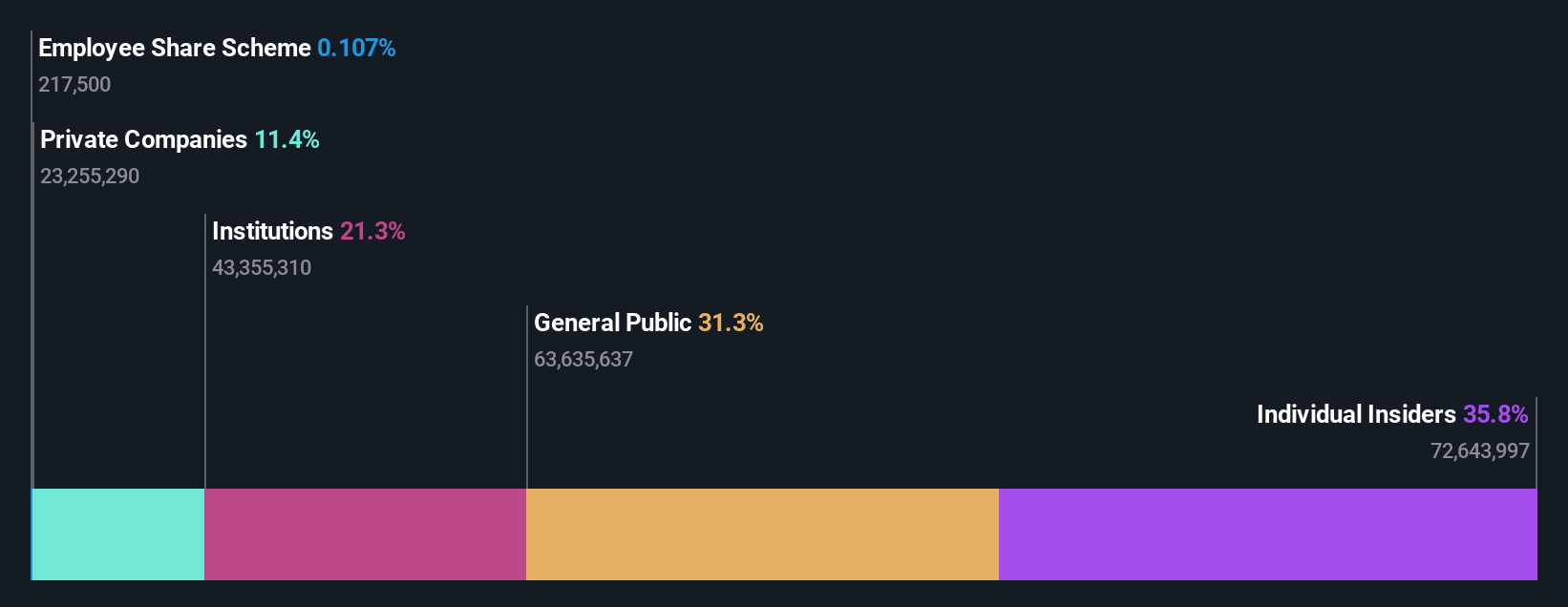

Insider Ownership: 36.1%

Revenue Growth Forecast: 20.7% p.a.

MTAR Technologies, a key participant in the Indian aerospace sector, has secured a long-term contract worth up to US$120 million with Israeli Aerospace Industries, promising substantial recurring business over the next 15 years. Despite a recent downturn in quarterly and annual net income and earnings per share, MTAR is poised for significant revenue growth (20.7% per year) and earnings expansion (27.8% per year), outpacing broader market averages. Insider transactions have been balanced recently, reflecting steady confidence from within.

- Delve into the full analysis future growth report here for a deeper understanding of MTAR Technologies.

- Our valuation report unveils the possibility MTAR Technologies' shares may be trading at a premium.

Pricol (NSEI:PRICOLLTD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pricol Limited is an Indian company that manufactures and sells instrument clusters and other automobile components to original equipment manufacturers and the replacement market, with a market capitalization of approximately ₹60.74 billion.

Operations: The company generates its revenue primarily from automotive components, amounting to ₹22.72 billion.

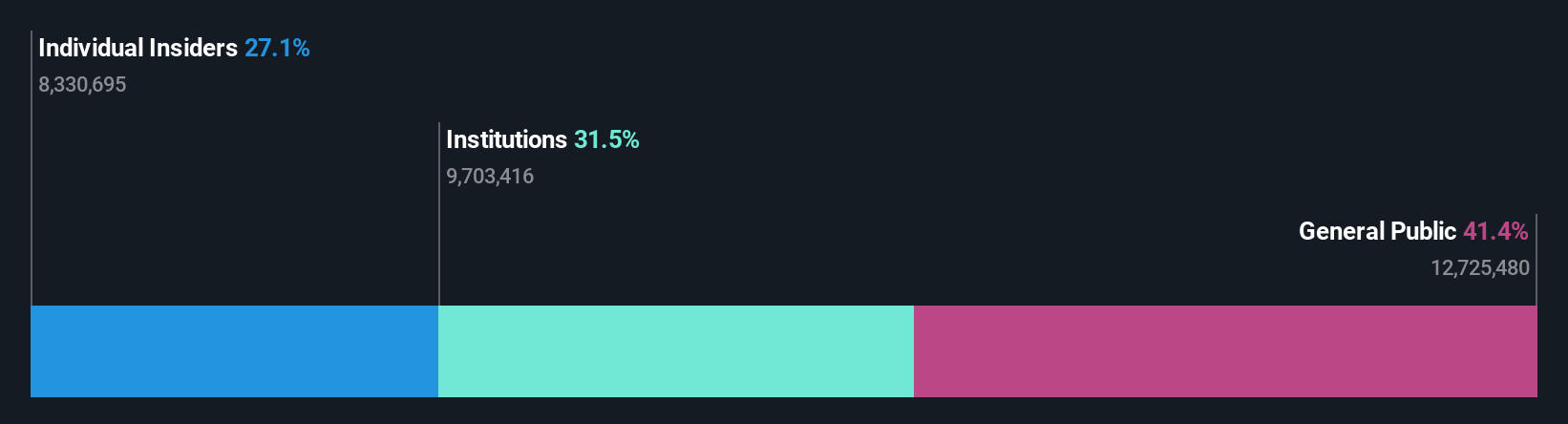

Insider Ownership: 25.5%

Revenue Growth Forecast: 17.3% p.a.

Pricol Limited, an Indian growth company with high insider ownership, has demonstrated robust financial performance with a significant increase in quarterly and annual earnings. Recent figures show a rise in net income to INR 415.02 million from INR 298.03 million year-over-year for the fourth quarter, alongside substantial full-year revenue growth to INR 22.85 billion. Forecasts predict earnings to grow significantly over the next three years, outperforming the broader Indian market's expectations. However, recent executive changes could impact future governance dynamics.

- Click here and access our complete growth analysis report to understand the dynamics of Pricol.

- The analysis detailed in our Pricol valuation report hints at an inflated share price compared to its estimated value.

Make It Happen

- Get an in-depth perspective on all 84 Fast Growing Indian Companies With High Insider Ownership by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MTARTECH

MTAR Technologies

Manufactures and sells high precision, heavy equipment, components, and machines in India and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives