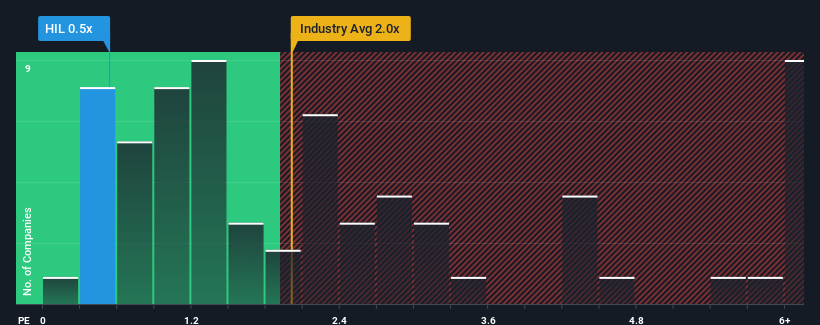

HIL Limited's (NSE:HIL) price-to-sales (or "P/S") ratio of 0.5x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Basic Materials industry in India have P/S ratios greater than 2x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for HIL

What Does HIL's P/S Mean For Shareholders?

There hasn't been much to differentiate HIL's and the industry's revenue growth lately. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on HIL will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like HIL's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.9% last year. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 15% during the coming year according to the dual analysts following the company. Meanwhile, the broader industry is forecast to contract by 4.5%, which would indicate the company is doing very well.

With this in mind, we find it intriguing that HIL's P/S falls short of its industry peers. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

The Bottom Line On HIL's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that HIL currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. When we see a superior revenue outlook with some actual growth, we can only assume investor uncertainty is what's been suppressing the P/S figures. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

There are also other vital risk factors to consider and we've discovered 4 warning signs for HIL (1 shouldn't be ignored!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if BirlaNu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BIRLANU

BirlaNu

Engages in the production and distribution of building materials and other solutions in India and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives