- India

- /

- Metals and Mining

- /

- NSEI:HARIOMPIPE

Hariom Pipe Industries' (NSE:HARIOMPIPE) Shareholders May Want To Dig Deeper Than Statutory Profit

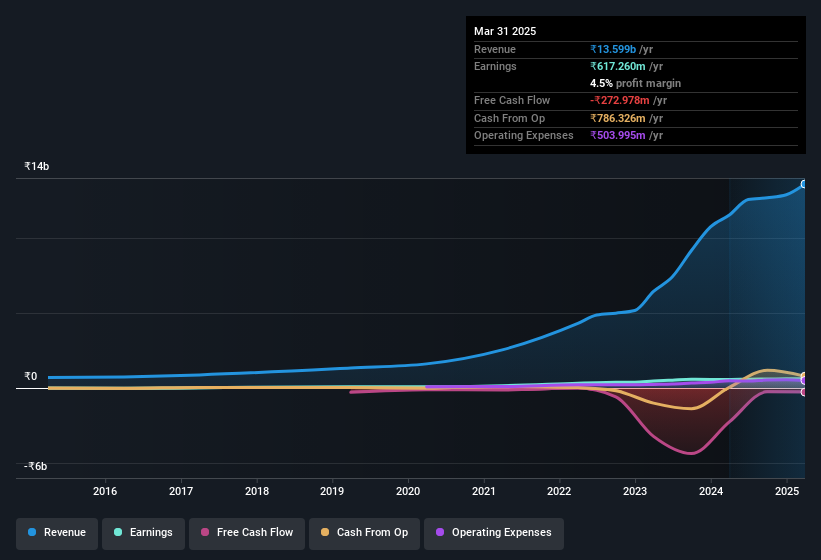

The recent earnings posted by Hariom Pipe Industries Limited (NSE:HARIOMPIPE) were solid, but the stock didn't move as much as we expected. We believe that shareholders have noticed some concerning factors beyond the statutory profit numbers.

We've discovered 1 warning sign about Hariom Pipe Industries. View them for free.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, Hariom Pipe Industries issued 7.3% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Hariom Pipe Industries' EPS by clicking here.

A Look At The Impact Of Hariom Pipe Industries' Dilution On Its Earnings Per Share (EPS)

As you can see above, Hariom Pipe Industries has been growing its net income over the last few years, with an annualized gain of 93% over three years. But EPS was only up 7.6% per year, in the exact same period. And over the last 12 months, the company grew its profit by 8.7%. On the other hand, earnings per share are pretty much flat, over the last twelve months. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, if Hariom Pipe Industries' earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Hariom Pipe Industries.

Our Take On Hariom Pipe Industries' Profit Performance

Hariom Pipe Industries shareholders should keep in mind how many new shares it is issuing, because, dilution clearly has the power to severely impact shareholder returns. Therefore, it seems possible to us that Hariom Pipe Industries' true underlying earnings power is actually less than its statutory profit. But at least holders can take some solace from the 7.6% per annum growth in EPS for the last three. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you want to do dive deeper into Hariom Pipe Industries, you'd also look into what risks it is currently facing. In terms of investment risks, we've identified 1 warning sign with Hariom Pipe Industries, and understanding this should be part of your investment process.

Today we've zoomed in on a single data point to better understand the nature of Hariom Pipe Industries' profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hariom Pipe Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HARIOMPIPE

Hariom Pipe Industries

Manufactures and sells iron and steel products in India.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion