We Discuss Why Gulshan Polyols Limited's (NSE:GULPOLY) CEO May Deserve A Higher Pay Packet

Key Insights

- Gulshan Polyols will host its Annual General Meeting on 20th of September

- Total pay for CEO Ashwani Vats includes ₹8.41m salary

- The overall pay is 51% below the industry average

- Gulshan Polyols' total shareholder return over the past three years was 19% while its EPS was down 37% over the past three years

Shareholders will be pleased by the robust performance of Gulshan Polyols Limited (NSE:GULPOLY) recently and this will be kept in mind in the upcoming AGM on 20th of September. They will probably be more interested in hearing the board discuss future initiatives to further improve the business as they vote on resolutions such as executive remuneration. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

View our latest analysis for Gulshan Polyols

How Does Total Compensation For Ashwani Vats Compare With Other Companies In The Industry?

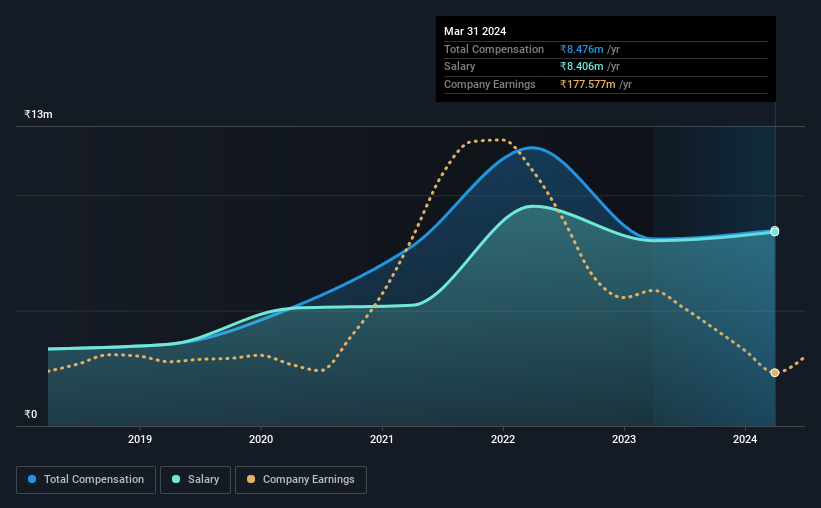

According to our data, Gulshan Polyols Limited has a market capitalization of ₹16b, and paid its CEO total annual compensation worth ₹8.5m over the year to March 2024. That's a fairly small increase of 4.7% over the previous year. In particular, the salary of ₹8.41m, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the Indian Chemicals industry with market capitalizations ranging from ₹8.4b to ₹34b, the reported median CEO total compensation was ₹17m. In other words, Gulshan Polyols pays its CEO lower than the industry median. Furthermore, Ashwani Vats directly owns ₹19m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₹8.4m | ₹8.0m | 99% |

| Other | ₹70k | ₹70k | 1% |

| Total Compensation | ₹8.5m | ₹8.1m | 100% |

Speaking on an industry level, nearly 89% of total compensation represents salary, while the remainder of 11% is other remuneration. Gulshan Polyols is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Gulshan Polyols Limited's Growth Numbers

Gulshan Polyols Limited has reduced its earnings per share by 37% a year over the last three years. It achieved revenue growth of 28% over the last year.

The reduction in EPS, over three years, is arguably concerning. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. It's hard to reach a conclusion about business performance right now. This may be one to watch. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Gulshan Polyols Limited Been A Good Investment?

Gulshan Polyols Limited has served shareholders reasonably well, with a total return of 19% over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

Ashwani receives almost all of their compensation through a salary. The company's overall performance, while not bad, could be better. If it manages to keep up the current streak, CEO remuneration could well be one of shareholders' least concerns. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 2 warning signs (and 1 which can't be ignored) in Gulshan Polyols we think you should know about.

Switching gears from Gulshan Polyols, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GULPOLY

Gulshan Polyols

Engages in the mineral and grain processing, and ethanol distillery businesses in India and internationally.

Proven track record with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion