Stock Analysis

- India

- /

- Paper and Forestry Products

- /

- NSEI:GREENPLY

Despite lower earnings than a year ago, Greenply Industries (NSE:GREENPLY) investors are up 66% since then

Greenply Industries Limited (NSE:GREENPLY) shareholders might be concerned after seeing the share price drop 11% in the last week. But that doesn't change the fact that the returns over the last year have been pleasing. Looking at the full year, the company has easily bested an index fund by gaining 65%.

Although Greenply Industries has shed ₹3.3b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

Check out our latest analysis for Greenply Industries

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last twelve months, Greenply Industries actually shrank its EPS by 52%.

This means it's unlikely the market is judging the company based on earnings growth. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

We are skeptical of the suggestion that the 0.2% dividend yield would entice buyers to the stock. However the year on year revenue growth of 19% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

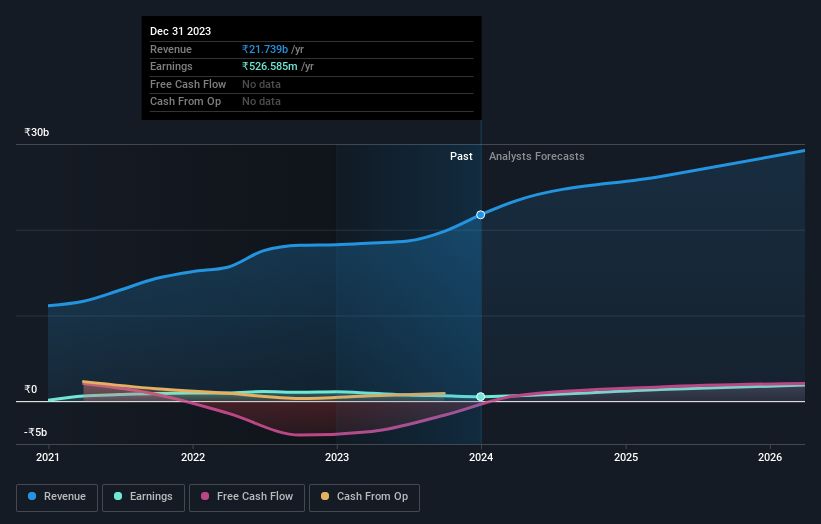

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Greenply Industries is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

It's good to see that Greenply Industries has rewarded shareholders with a total shareholder return of 66% in the last twelve months. And that does include the dividend. That gain is better than the annual TSR over five years, which is 15%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Greenply Industries (of which 1 shouldn't be ignored!) you should know about.

Of course Greenply Industries may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Greenply Industries is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GREENPLY

Greenply Industries

Greenply Industries Limited, an interior infrastructure company, manufactures, markets, trades in, and distributes plywood and allied products in India and internationally.

Reasonable growth potential with imperfect balance sheet.