- India

- /

- Paper and Forestry Products

- /

- NSEI:GREENPANEL

Greenpanel Industries (NSE:GREENPANEL) Shareholders Have Enjoyed An Impressive 267% Share Price Gain

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. Take, for example Greenpanel Industries Limited (NSE:GREENPANEL). Its share price is already up an impressive 267% in the last twelve months. On top of that, the share price is up 109% in about a quarter. Greenpanel Industries hasn't been listed for long, so it's still not clear if it is a long term winner.

View our latest analysis for Greenpanel Industries

We don't think that Greenpanel Industries' modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Greenpanel Industries grew its revenue by 6.8% last year. That's not great considering the company is losing money. So we wouldn't have expected the share price to rise by 267%. We're happy that investors have made money, though we wonder if the increase will be sustained. It's quite likely that the market is considering other factors, not just revenue growth.

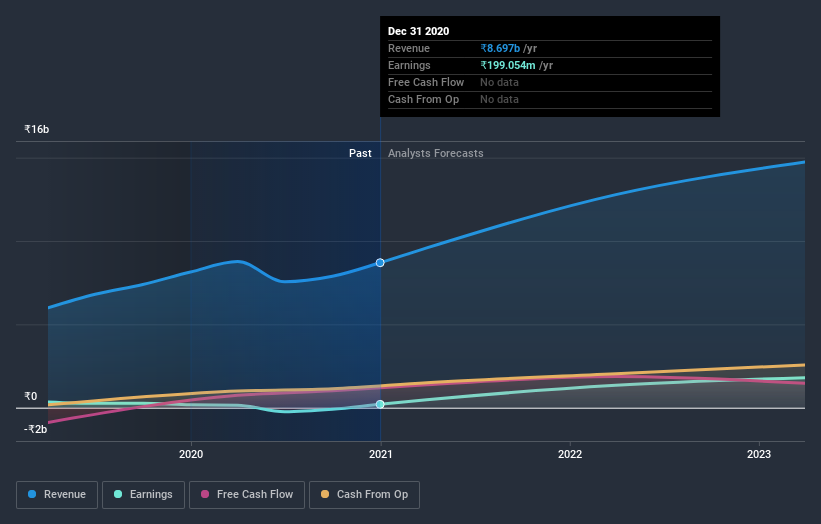

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So it makes a lot of sense to check out what analysts think Greenpanel Industries will earn in the future (free profit forecasts).

A Different Perspective

Greenpanel Industries boasts a total shareholder return of 267% for the last year. A substantial portion of that gain has come in the last three months, with the stock up 109% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. It's always interesting to track share price performance over the longer term. But to understand Greenpanel Industries better, we need to consider many other factors. Take risks, for example - Greenpanel Industries has 3 warning signs (and 1 which is a bit concerning) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade Greenpanel Industries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:GREENPANEL

Greenpanel Industries

Engages in the manufacturing and sale of plywood, medium density fibre board (MDF), and allied products under the Greenpanel brand name in India and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives