- India

- /

- Metals and Mining

- /

- NSEI:GANGAFORGE

Does Ganga Forging (NSE:GANGAFORGE) Deserve A Spot On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Ganga Forging (NSE:GANGAFORGE). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Ganga Forging

How Fast Is Ganga Forging Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, Ganga Forging has grown EPS by 23% per year, compound, in the last three years. As a result, we can understand why the stock trades on a high multiple of trailing twelve month earnings.

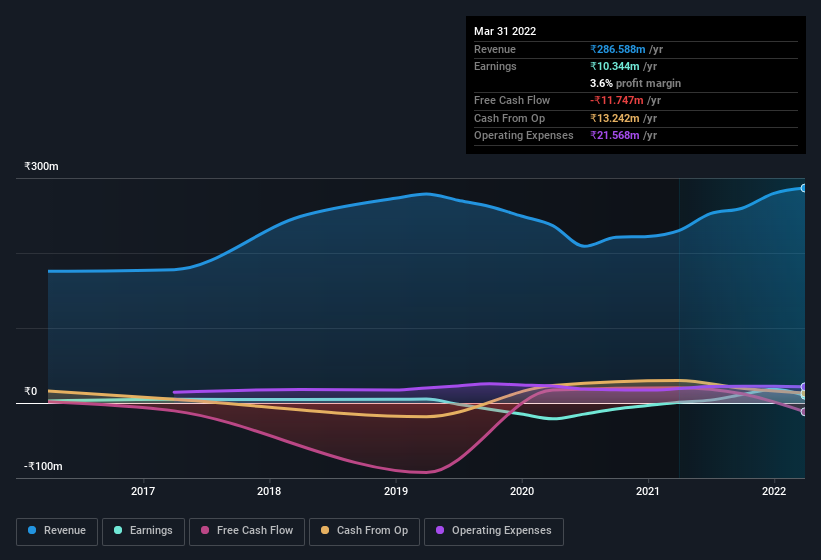

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Ganga Forging achieved similar EBIT margins to last year, revenue grew by a solid 25% to ₹287m. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Since Ganga Forging is no giant, with a market capitalisation of ₹683m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Ganga Forging Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So as you can imagine, the fact that Ganga Forging insiders own a significant number of shares certainly is appealing. Indeed, with a collective holding of 85%, company insiders are in control and have plenty of capital behind the venture. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. Of course, Ganga Forging is a very small company, with a market cap of only ₹683m. That means insiders only have ₹579m worth of shares, despite the large proportional holding. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Well, based on the CEO pay, you'd argue that they are indeed. Our analysis has discovered that the median total compensation for the CEOs of companies like Ganga Forging with market caps under ₹16b is about ₹3.0m.

The CEO of Ganga Forging was paid just ₹1.5m in total compensation for the year ending March 2021. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Is Ganga Forging Worth Keeping An Eye On?

You can't deny that Ganga Forging has grown its earnings per share at a very impressive rate. That's attractive. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. Everyone has their own preferences when it comes to investing but it definitely makes Ganga Forging look rather interesting indeed. We should say that we've discovered 4 warning signs for Ganga Forging (2 don't sit too well with us!) that you should be aware of before investing here.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GANGAFORGE

Ganga Forging

Manufactures and sells steel forging parts and machine components for automotive and non-automotive sectors in India.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives