- India

- /

- Metals and Mining

- /

- NSEI:GANDHITUBE

Is It Smart To Buy Gandhi Special Tubes Limited (NSE:GANDHITUBE) Before It Goes Ex-Dividend?

Gandhi Special Tubes Limited (NSE:GANDHITUBE) stock is about to trade ex-dividend in three days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. This means that investors who purchase Gandhi Special Tubes' shares on or after the 5th of August will not receive the dividend, which will be paid on the 11th of September.

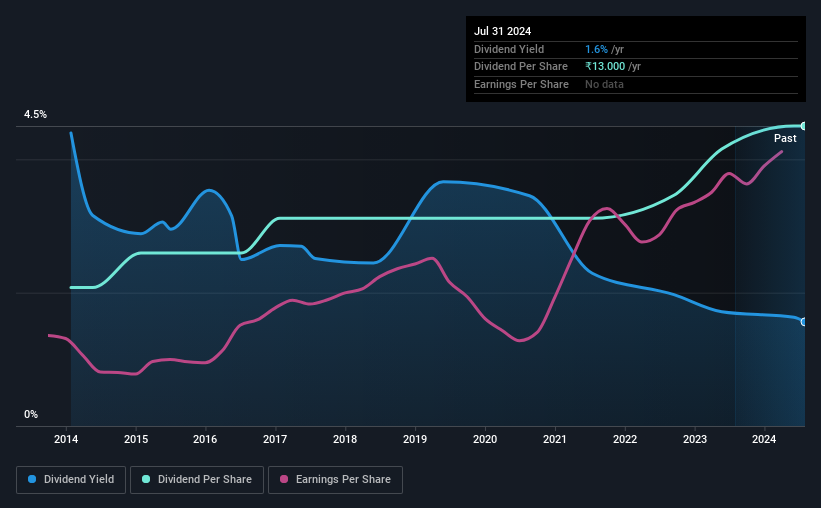

The company's next dividend payment will be ₹13.00 per share, on the back of last year when the company paid a total of ₹13.00 to shareholders. Looking at the last 12 months of distributions, Gandhi Special Tubes has a trailing yield of approximately 1.6% on its current stock price of ₹834.70. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

See our latest analysis for Gandhi Special Tubes

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. That's why it's good to see Gandhi Special Tubes paying out a modest 28% of its earnings. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. It paid out more than half (64%) of its free cash flow in the past year, which is within an average range for most companies.

It's positive to see that Gandhi Special Tubes's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit Gandhi Special Tubes paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Fortunately for readers, Gandhi Special Tubes's earnings per share have been growing at 10% a year for the past five years. Gandhi Special Tubes has an average payout ratio which suggests a balance between growing earnings and rewarding shareholders. Given the quick rate of earnings per share growth and current level of payout, there may be a chance of further dividend increases in the future.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Since the start of our data, 10 years ago, Gandhi Special Tubes has lifted its dividend by approximately 8.0% a year on average. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

To Sum It Up

Has Gandhi Special Tubes got what it takes to maintain its dividend payments? From a dividend perspective, we're encouraged to see that earnings per share have been growing, the company is paying out less than half of its earnings, and a bit over half its free cash flow. Overall we think this is an attractive combination and worthy of further research.

Want to learn more about Gandhi Special Tubes's dividend performance? Check out this visualisation of its historical revenue and earnings growth.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:GANDHITUBE

Gandhi Special Tubes

Manufactures and markets welded and seamless steel tubes, and nuts in India and internationally.

6 star dividend payer with excellent balance sheet.