- India

- /

- Real Estate

- /

- NSEI:ARKADE

Undiscovered Gems in India to Watch This September 2024

Reviewed by Simply Wall St

Over the past 7 days, the Indian market has risen 1.6%, and over the past 12 months, it is up an impressive 44%. In this thriving environment where earnings are expected to grow by 17% per annum over the next few years, identifying undiscovered gems can offer significant potential for investors looking to capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| All E Technologies | NA | 40.78% | 31.63% | ★★★★★★ |

| Vidhi Specialty Food Ingredients | 7.27% | 11.00% | 4.02% | ★★★★★★ |

| Yuken India | 27.96% | 12.35% | -44.41% | ★★★★★★ |

| ELANTAS Beck India | NA | 14.89% | 24.83% | ★★★★★★ |

| Timex Group India | 14.33% | 17.75% | 59.68% | ★★★★★★ |

| Pearl Global Industries | 72.24% | 19.89% | 41.91% | ★★★★★☆ |

| Om Infra | 13.99% | 43.36% | 27.66% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.44% | 61.28% | ★★★★★☆ |

| Innovana Thinklabs | 13.59% | 12.51% | 20.01% | ★★★★☆☆ |

| Rir Power Electronics | 54.23% | 16.42% | 34.78% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Arkade Developers (NSEI:ARKADE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Arkade Developers Limited operates as a real estate development company in India with a market cap of ₹28.94 billion.

Operations: Arkade Developers generates revenue primarily from real estate development projects. The company reported a market cap of ₹28.94 billion.

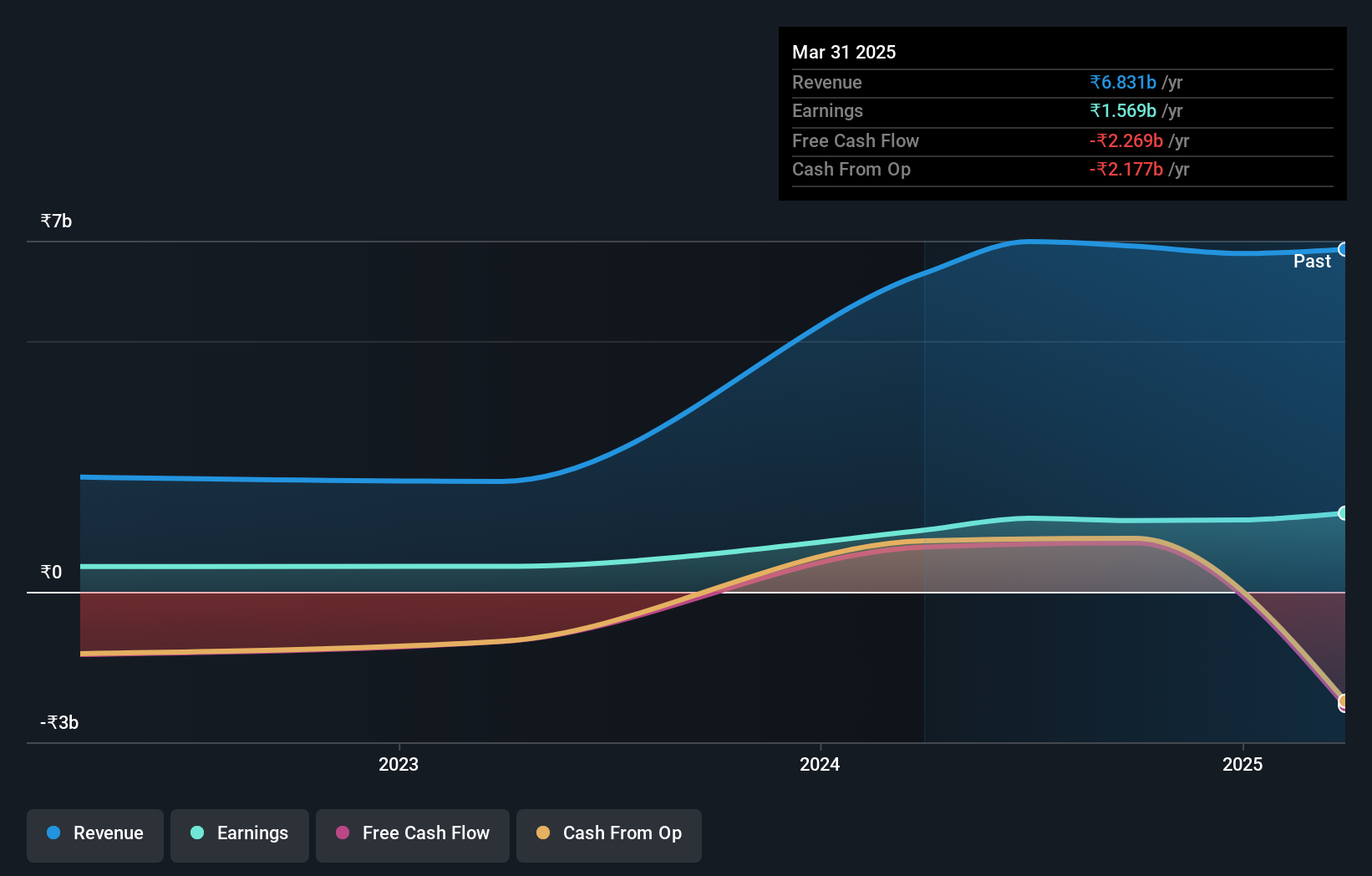

Arkade Developers recently completed an IPO raising INR 4.1 billion, signaling strong market interest. Over the past year, earnings surged by 142%, significantly outpacing the real estate industry's growth of 24%. Their net income for FY2024 was INR 1.23 billion compared to INR 508 million the previous year, showcasing robust financial health. With a satisfactory net debt to equity ratio of 13.8% and EBIT covering interest payments by over 53 times, Arkade's financial stability is evident despite its highly illiquid shares.

- Get an in-depth perspective on Arkade Developers' performance by reading our health report here.

Understand Arkade Developers' track record by examining our Past report.

Godawari Power & Ispat (NSEI:GPIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Godawari Power & Ispat Limited, along with its subsidiaries, operates in the mining of iron ores in India and has a market cap of ₹134.62 billion.

Operations: GPIL generates revenue primarily from iron ore mining. The company reported a gross profit margin of 35% in the latest fiscal year, reflecting its cost efficiency in operations.

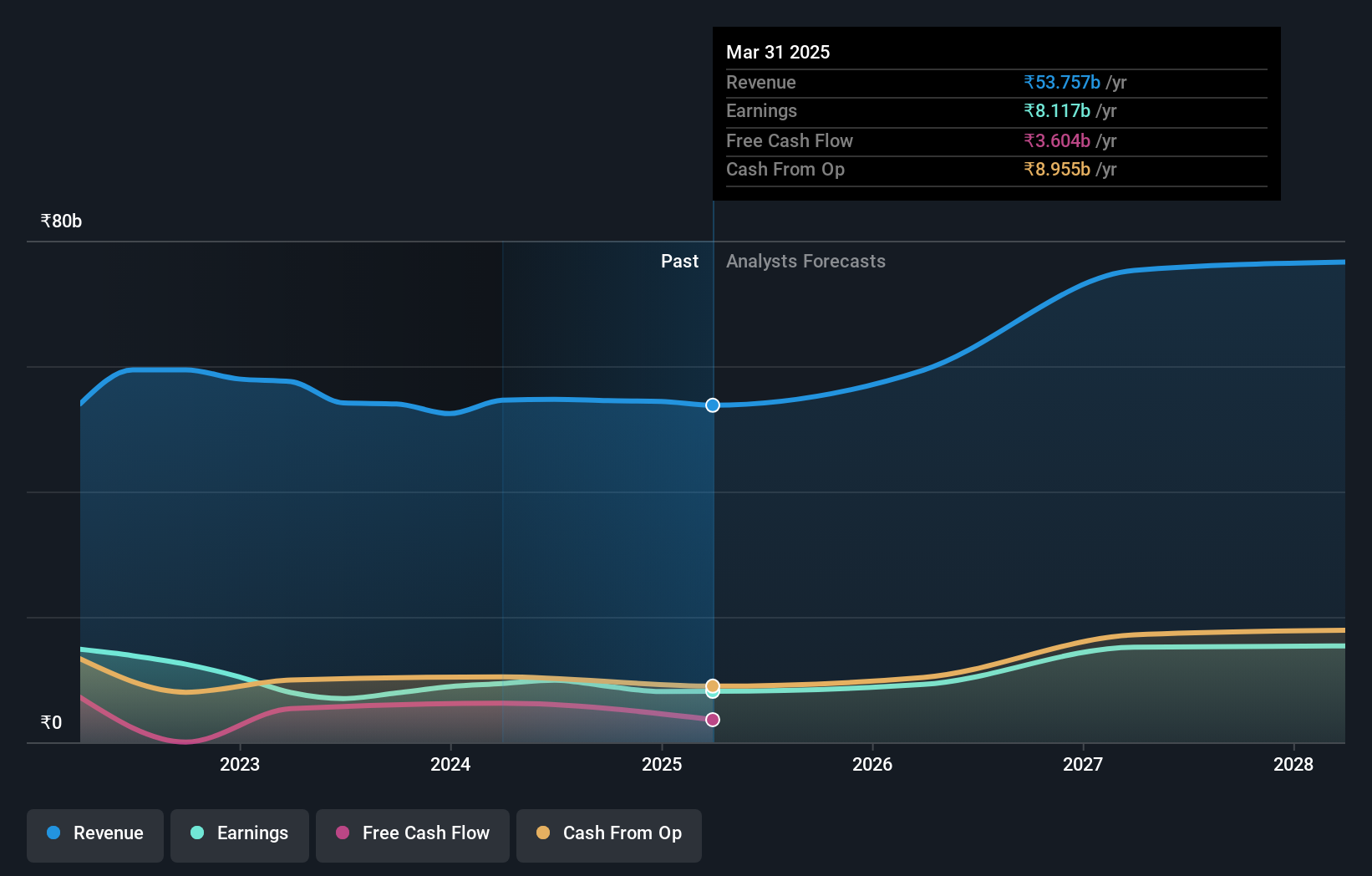

Godawari Power & Ispat has made significant strides, notably reducing its debt to equity ratio from 141.1% to 1.1% over the past five years. The company reported earnings growth of 42.1% last year, outpacing the Metals and Mining industry's 17.8%. Trading at a price-to-earnings ratio of 13.9x, it presents good value compared to the Indian market's 34.4x average. Recent developments include a proposed share split and special dividend on its 25th anniversary, reflecting strong financial health and shareholder focus.

- Navigate through the intricacies of Godawari Power & Ispat with our comprehensive health report here.

Explore historical data to track Godawari Power & Ispat's performance over time in our Past section.

JSW Holdings (NSEI:JSWHL)

Simply Wall St Value Rating: ★★★★★☆

Overview: JSW Holdings Limited, a non-banking financial company, primarily engages in investing and financing activities in India with a market cap of ₹102.52 billion.

Operations: JSW Holdings generates revenue of ₹1.71 billion from its investing and financing activities. The company has a market cap of ₹102.52 billion.

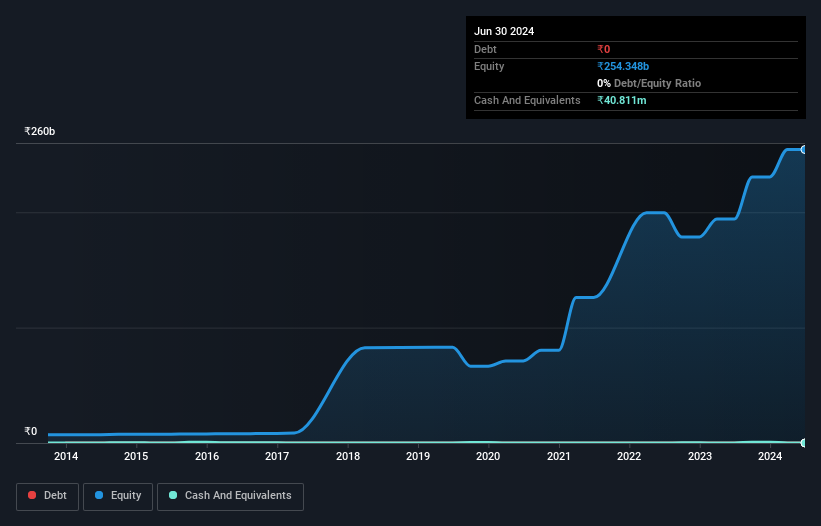

JSW Holdings, a lesser-known player in India's investment landscape, recently joined the S&P Global BMI Index. The company reported first-quarter revenue of ₹272.32 million (up from ₹261.16 million) and net income of ₹525.81 million (up from ₹243.57 million). Basic earnings per share surged to ₹47.38 from last year's ₹21.95. Despite negative earnings growth of -47% over the past year, JSW Holdings remains debt-free with robust free cash flow and high-quality earnings, signaling financial stability amidst industry challenges.

- Unlock comprehensive insights into our analysis of JSW Holdings stock in this health report.

Gain insights into JSW Holdings' past trends and performance with our Past report.

Next Steps

- Delve into our full catalog of 479 Indian Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ARKADE

Arkade Developers

Operates as a real estate development company in India.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)