Excel Industries Full Year 2024 Earnings: EPS: ₹13.53 (vs ₹63.59 in FY 2023)

Excel Industries (NSE:EXCELINDUS) Full Year 2024 Results

Key Financial Results

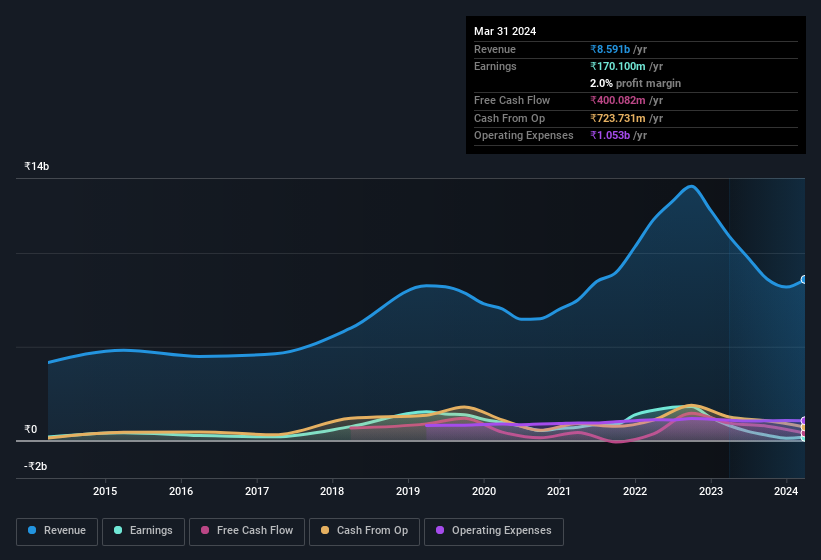

- Revenue: ₹8.59b (down 21% from FY 2023).

- Net income: ₹170.1m (down 79% from FY 2023).

- Profit margin: 2.0% (down from 7.3% in FY 2023). The decrease in margin was driven by lower revenue.

- EPS: ₹13.53 (down from ₹63.59 in FY 2023).

All figures shown in the chart above are for the trailing 12 month (TTM) period

Excel Industries' share price is broadly unchanged from a week ago.

Risk Analysis

It is worth noting though that we have found 4 warning signs for Excel Industries (1 is a bit concerning!) that you need to take into consideration.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Excel Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:EXCELINDUS

Excel Industries

Engages in manufactures and sells chemicals, and environmental and biotech products and services in India and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion