- India

- /

- Renewable Energy

- /

- NSEI:JPPOWER

Uncovering 3 Hidden Gems in India with Promising Potential

Reviewed by Simply Wall St

The Indian market has remained flat over the past week but has impressively risen by 45% in the last year, with earnings projected to grow by 17% annually. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be crucial for investors seeking to capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wealth First Portfolio Managers | NA | -47.95% | 40.47% | ★★★★★★ |

| Vidhi Specialty Food Ingredients | 7.27% | 11.00% | 4.02% | ★★★★★★ |

| Kokuyo Camlin | 27.11% | 23.20% | 75.70% | ★★★★★★ |

| Force Motors | 23.24% | 21.52% | 44.24% | ★★★★★☆ |

| Pearl Global Industries | 72.24% | 19.89% | 41.91% | ★★★★★☆ |

| Avantel | 10.67% | 34.84% | 36.61% | ★★★★★☆ |

| Magadh Sugar & Energy | 85.44% | 6.65% | 13.60% | ★★★★☆☆ |

| Innovana Thinklabs | 13.59% | 12.51% | 20.01% | ★★★★☆☆ |

| SG Mart | 16.77% | 98.09% | 96.54% | ★★★★☆☆ |

| Rir Power Electronics | 54.23% | 16.42% | 34.78% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

E.I.D.- Parry (India) (NSEI:EIDPARRY)

Simply Wall St Value Rating: ★★★★★★

Overview: E.I.D.- Parry (India) Limited, along with its subsidiaries, operates in the manufacturing and sale of sugar, nutraceuticals, and distillery products across India and international markets, with a market cap of ₹154.13 billion.

Operations: E.I.D.- Parry (India) Limited generates revenue primarily from its Nutrient and Allied Business, contributing ₹187.88 billion, followed by Crop Protection at ₹24.61 billion. The Distillery segment adds ₹8.54 billion to the revenue stream, while Nutraceuticals contribute ₹2.34 billion.

E.I.D.- Parry (India), a notable player in India's market, has shown resilience with its debt-to-equity ratio dropping from 132.9% to 15.6% over five years, highlighting effective financial management. Earnings grew by 13%, surpassing the industry average of 10.7%. Despite a recent dip in net income to ₹913 million from ₹1,089 million last year, the company remains profitable with strong cash flow and an attractive P/E ratio of 17.5x against the market's 34.3x.

Jaiprakash Power Ventures (NSEI:JPPOWER)

Simply Wall St Value Rating: ★★★★★☆

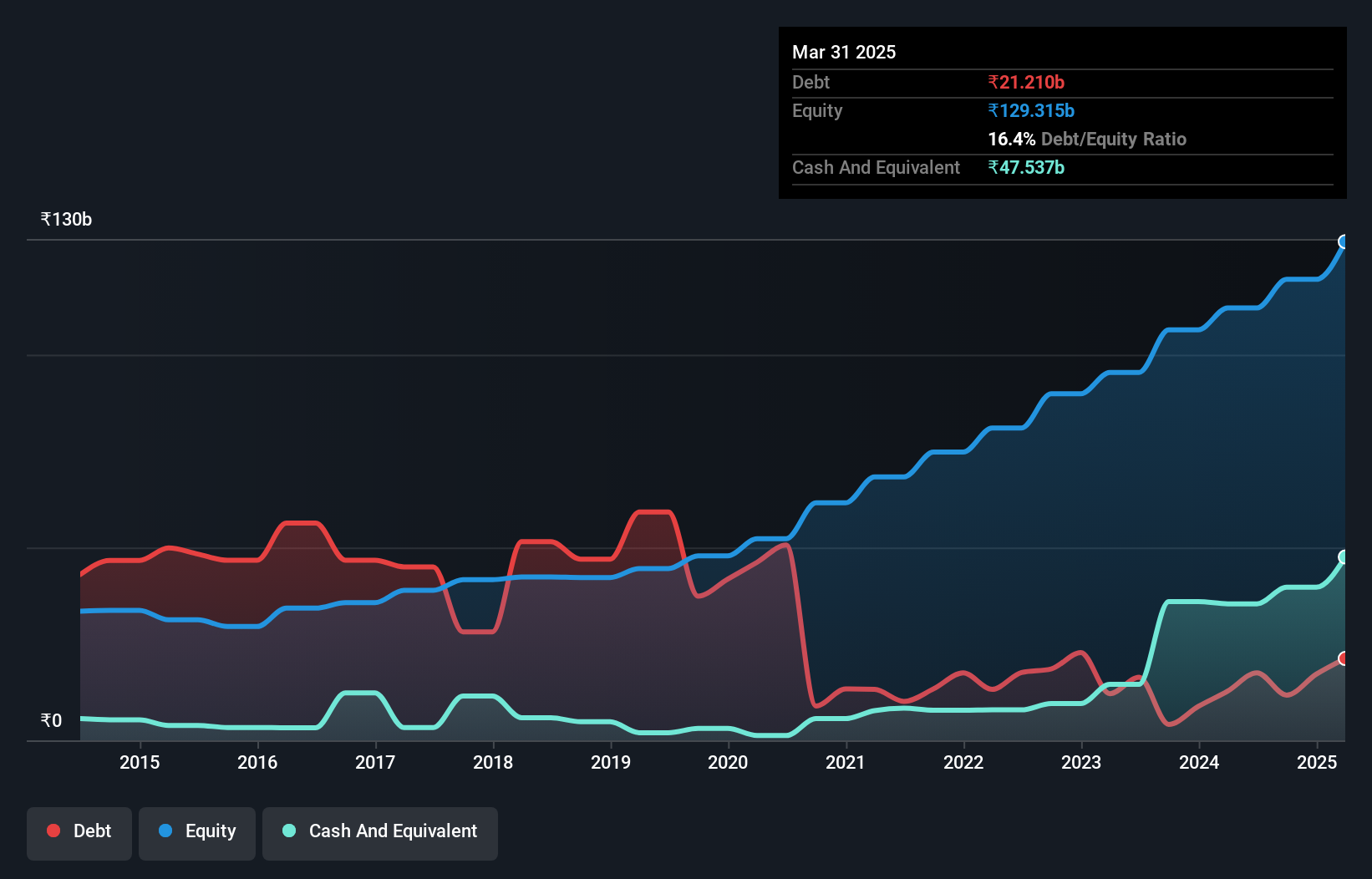

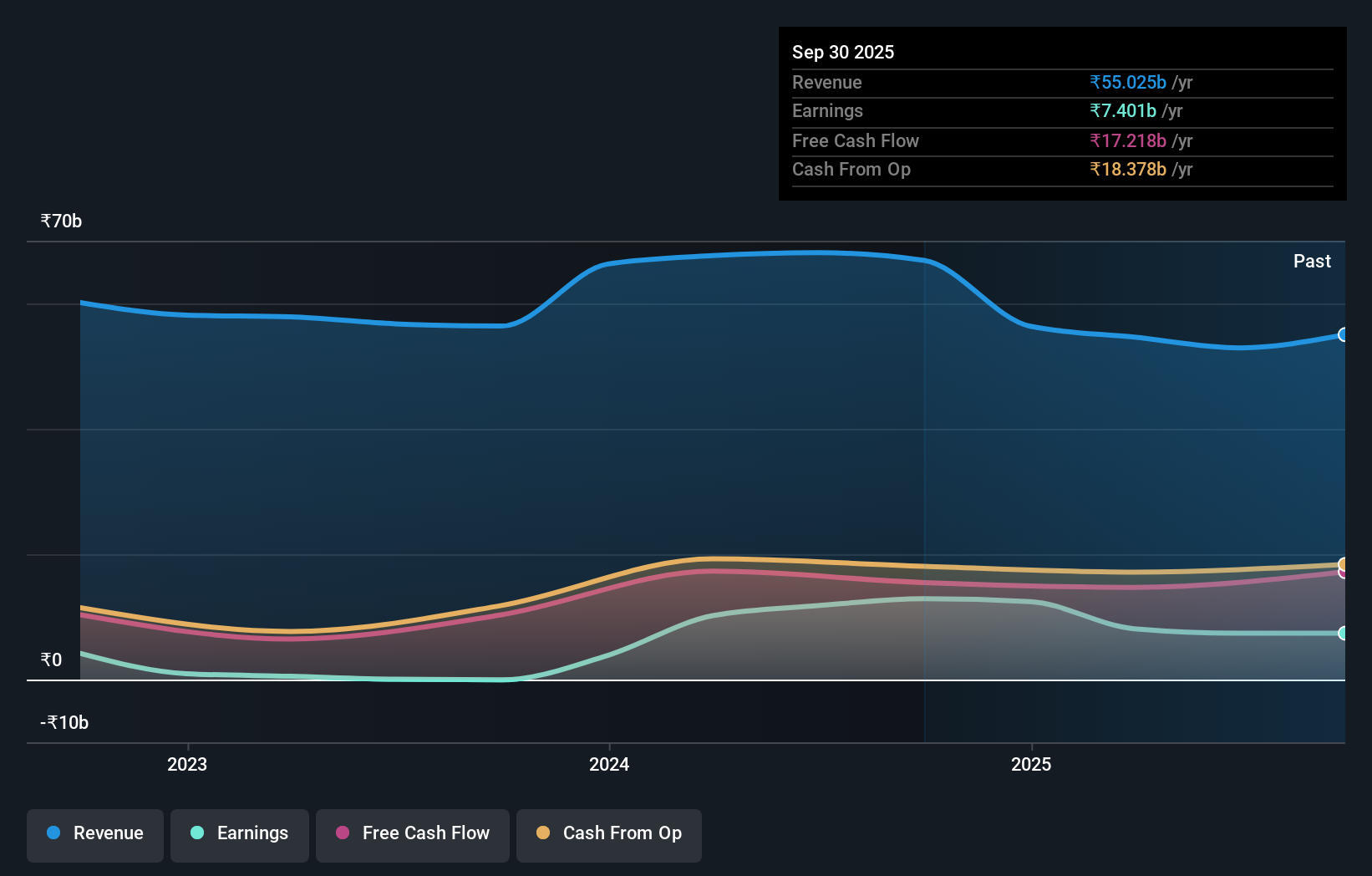

Overview: Jaiprakash Power Ventures Limited operates in the power generation and cement grinding sectors both domestically and internationally, with a market capitalization of ₹131.24 billion.

Operations: JPPOWER generates revenue primarily from its power segment, contributing ₹61.68 billion, and coal segment with ₹6.59 billion. The company faces a segment adjustment of ₹6.42 billion.

JP Power seems to be an intriguing player in the energy sector, with earnings soaring by 22,969% over the past year, outpacing industry growth of 12%. Despite a significant one-off loss of ₹6.9 billion impacting recent results, its debt-to-equity ratio has impressively reduced from 254.1% to 37% over five years. Trading at a substantial discount of 68.4% below estimated fair value and boasting positive free cash flow, it presents a compelling case for value seekers.

Ujaas Energy (NSEI:UEL)

Simply Wall St Value Rating: ★★★★★☆

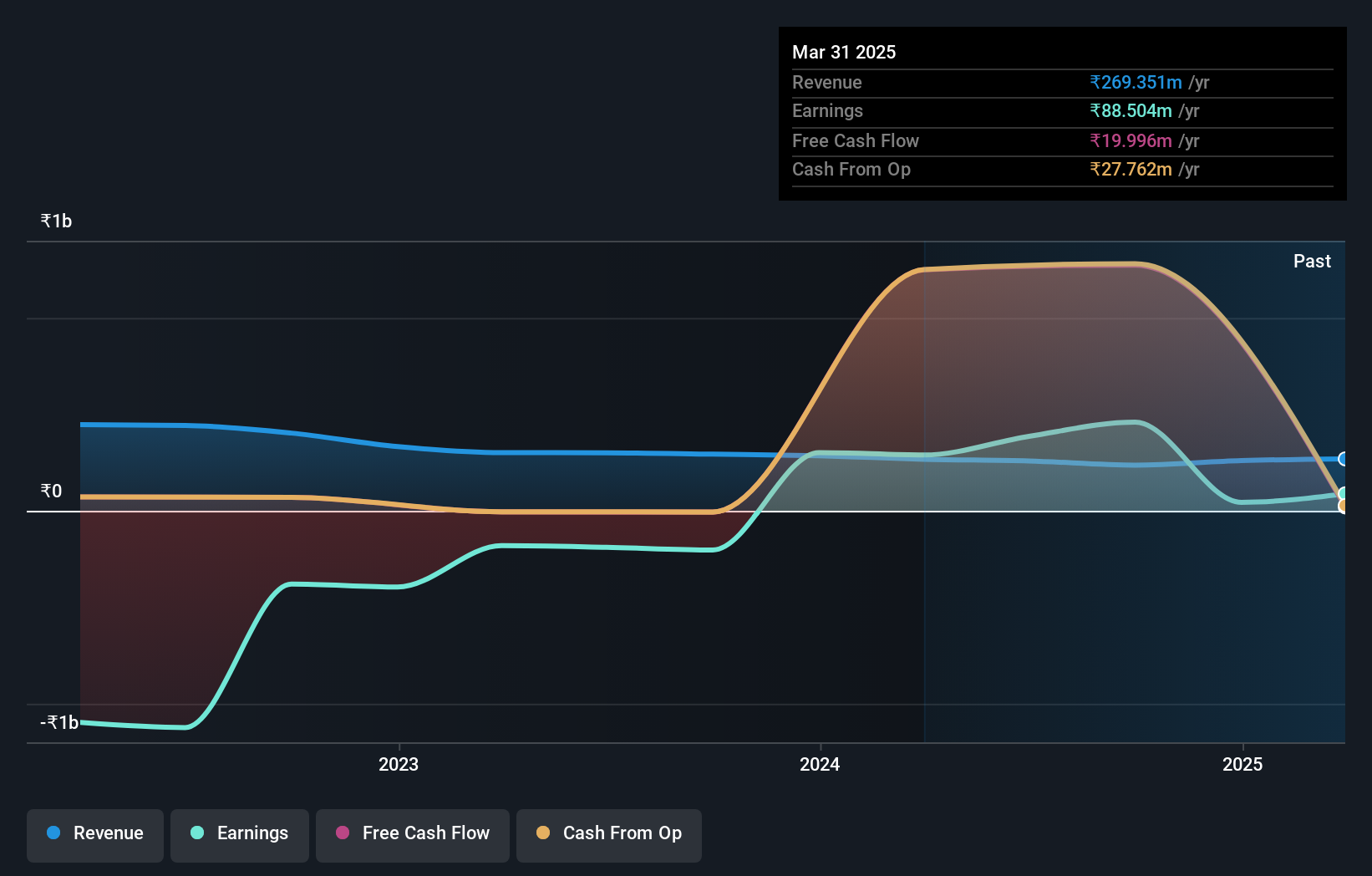

Overview: Ujaas Energy Limited focuses on the generation of solar power in India with a market capitalization of ₹69.46 billion.

Operations: Ujaas Energy derives its revenue primarily from the operation of solar power plants, contributing ₹307.70 million to its total revenue. The electric vehicle segment adds another ₹41.00 million in revenue.

Ujaas Energy, a small player in India's energy sector, has seen significant financial shifts. Recently turning profitable with a net income of ₹38.15M for Q1 2024, it marked a turnaround from the previous year's loss of ₹58.57M. The company's debt to equity ratio improved from 59.4% to 20.8% over five years, indicating better financial health. Despite these gains, shareholders experienced dilution and shares remain highly illiquid, challenging its growth narrative amidst industry changes.

- Click to explore a detailed breakdown of our findings in Ujaas Energy's health report.

Assess Ujaas Energy's past performance with our detailed historical performance reports.

Make It Happen

- Click through to start exploring the rest of the 471 Indian Undiscovered Gems With Strong Fundamentals now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JPPOWER

Jaiprakash Power Ventures

Engages in the power generation and cement grinding businesses in India.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives