Additional Considerations Required While Assessing Dharmaj Crop Guard's (NSE:DHARMAJ) Strong Earnings

Despite announcing strong earnings, Dharmaj Crop Guard Limited's (NSE:DHARMAJ) stock was sluggish. We did some digging and found some worrying underlying problems.

View our latest analysis for Dharmaj Crop Guard

A Closer Look At Dharmaj Crop Guard's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

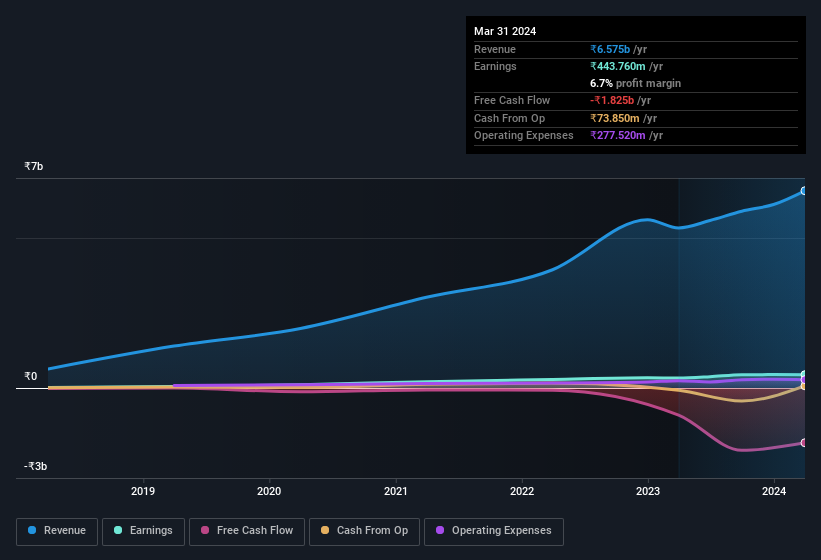

For the year to March 2024, Dharmaj Crop Guard had an accrual ratio of 0.63. As a general rule, that bodes poorly for future profitability. And indeed, during the period the company didn't produce any free cash flow whatsoever. Over the last year it actually had negative free cash flow of ₹1.8b, in contrast to the aforementioned profit of ₹443.8m. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of ₹1.8b, this year, indicates high risk.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Dharmaj Crop Guard.

Our Take On Dharmaj Crop Guard's Profit Performance

As we have made quite clear, we're a bit worried that Dharmaj Crop Guard didn't back up the last year's profit with free cashflow. As a result, we think it may well be the case that Dharmaj Crop Guard's underlying earnings power is lower than its statutory profit. But at least holders can take some solace from the 55% per annum growth in EPS for the last three. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. For instance, we've identified 2 warning signs for Dharmaj Crop Guard (1 is potentially serious) you should be familiar with.

This note has only looked at a single factor that sheds light on the nature of Dharmaj Crop Guard's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DHARMAJ

Dharmaj Crop Guard

Engages in manufacturing, distributing, and marketing of a range of agro chemical formulations in India.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Sunny Returns with On the Beach

High Quality Business and a true compounding machine

Roche Holding AG To Benefit From Strong Drug Pipeline In 2027 And Beyond

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion

AGAG still in exploration, in bull market, such company will be the last to participate. It's high risk but can results in 20-30 baggers potential. The best play with current bull are with producers or near-producer miners, you can get 5-10 baggers with much lower risk. See my analysis on santacruz silver, andean silver.