Here's Why I Think Deepak Nitrite (NSE:DEEPAKNTR) Is An Interesting Stock

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Deepak Nitrite (NSE:DEEPAKNTR). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Deepak Nitrite

Deepak Nitrite's Improving Profits

In the last three years Deepak Nitrite's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a wedge-tailed eagle on the wind, Deepak Nitrite's EPS soared from ₹48.24 to ₹79.88, in just one year. That's a impressive gain of 66%.

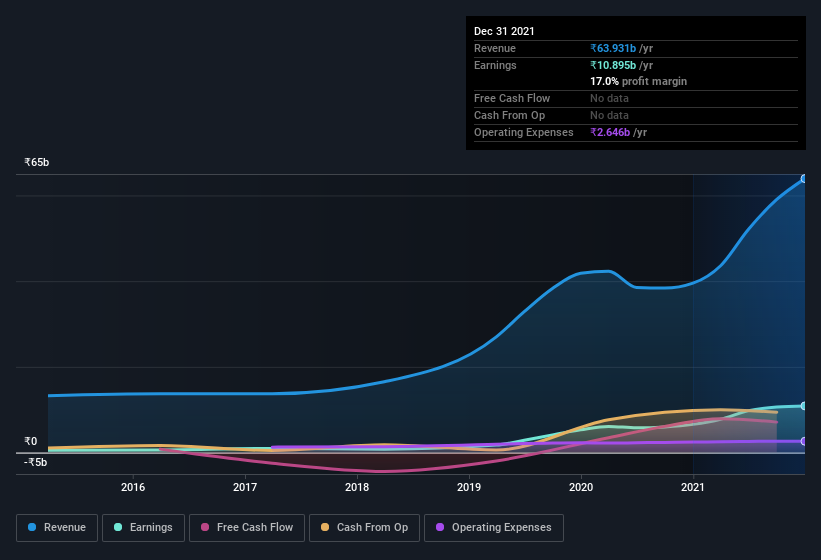

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Deepak Nitrite maintained stable EBIT margins over the last year, all while growing revenue 62% to ₹64b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Deepak Nitrite's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Deepak Nitrite Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for Deepak Nitrite shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Kishor Jhalaria, the of the company, paid ₹3.4m for shares at around ₹2,122 each.

On top of the insider buying, it's good to see that Deepak Nitrite insiders have a valuable investment in the business. Notably, they have an enormous stake in the company, worth ₹52b. That equates to 17% of the company, making insiders powerful and aligned with other shareholders. So it might be my imagination, but I do sense the glimmer of an opportunity.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Maulik Mehta, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Deepak Nitrite with market caps between ₹152b and ₹486b is about ₹43m.

Deepak Nitrite offered total compensation worth ₹26m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Deepak Nitrite To Your Watchlist?

You can't deny that Deepak Nitrite has grown its earnings per share at a very impressive rate. That's attractive. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So I do think this is one stock worth watching. Now, you could try to make up your mind on Deepak Nitrite by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

The good news is that Deepak Nitrite is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DEEPAKNTR

Deepak Nitrite

Manufactures, trades and sells chemical intermediates in India and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives