Deepak Fertilisers And Petrochemicals Corporation Limited (NSE:DEEPAKFERT) Stock Rockets 33% But Many Are Still Ignoring The Company

Deepak Fertilisers And Petrochemicals Corporation Limited (NSE:DEEPAKFERT) shares have continued their recent momentum with a 33% gain in the last month alone. The last month tops off a massive increase of 120% in the last year.

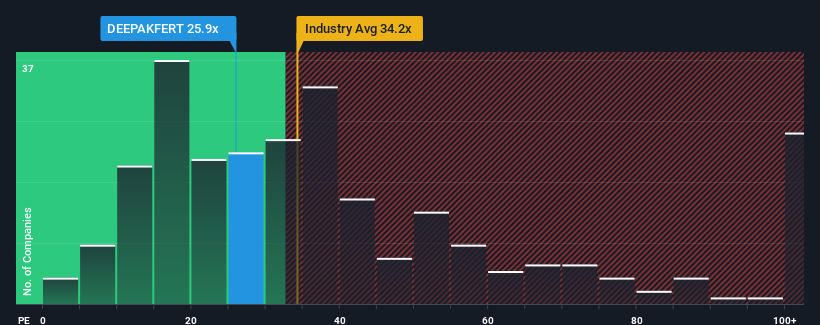

Although its price has surged higher, Deepak Fertilisers And Petrochemicals may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 25.9x, since almost half of all companies in India have P/E ratios greater than 34x and even P/E's higher than 64x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Deepak Fertilisers And Petrochemicals could be doing better as it's been growing earnings less than most other companies lately. It seems that many are expecting the uninspiring earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping earnings don't get any worse and that you could pick up some stock while it's out of favour.

See our latest analysis for Deepak Fertilisers And Petrochemicals

How Is Deepak Fertilisers And Petrochemicals' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Deepak Fertilisers And Petrochemicals' is when the company's growth is on track to lag the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Although pleasingly EPS has lifted 34% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 19% per year during the coming three years according to the dual analysts following the company. That's shaping up to be similar to the 20% per annum growth forecast for the broader market.

With this information, we find it odd that Deepak Fertilisers And Petrochemicals is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

The latest share price surge wasn't enough to lift Deepak Fertilisers And Petrochemicals' P/E close to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Deepak Fertilisers And Petrochemicals currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Deepak Fertilisers And Petrochemicals that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DEEPAKFERT

Deepak Fertilisers And Petrochemicals

Engages in the manufacture, trade, and sale of bulk chemicals in India.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives