Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, DCW Limited (NSE:DCW) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for DCW

What Is DCW's Net Debt?

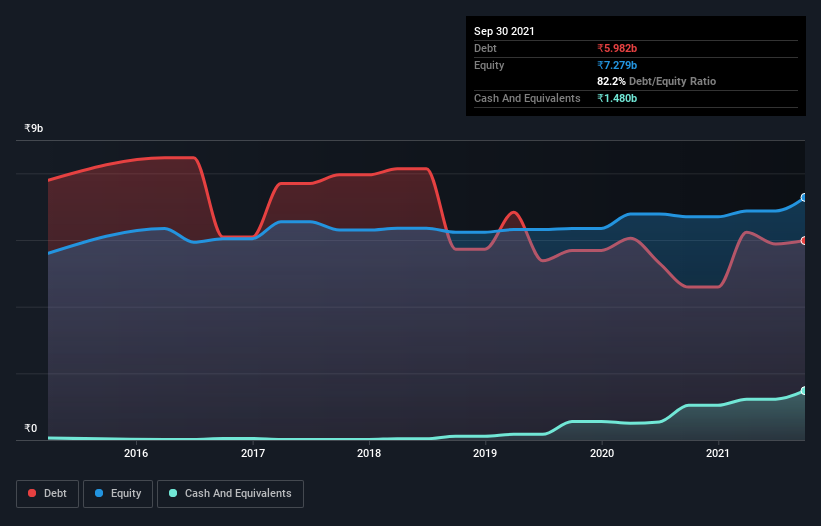

You can click the graphic below for the historical numbers, but it shows that as of September 2021 DCW had ₹5.98b of debt, an increase on ₹4.59b, over one year. On the flip side, it has ₹1.48b in cash leading to net debt of about ₹4.50b.

How Healthy Is DCW's Balance Sheet?

According to the last reported balance sheet, DCW had liabilities of ₹6.52b due within 12 months, and liabilities of ₹5.97b due beyond 12 months. Offsetting this, it had ₹1.48b in cash and ₹1.16b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹9.85b.

This deficit is considerable relative to its market capitalization of ₹12.1b, so it does suggest shareholders should keep an eye on DCW's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While DCW has a quite reasonable net debt to EBITDA multiple of 1.7, its interest cover seems weak, at 1.6. This does have us wondering if the company pays high interest because it is considered risky. In any case, it's safe to say the company has meaningful debt. Notably, DCW's EBIT launched higher than Elon Musk, gaining a whopping 315% on last year. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since DCW will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Happily for any shareholders, DCW actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Both DCW's ability to to convert EBIT to free cash flow and its EBIT growth rate gave us comfort that it can handle its debt. But truth be told its interest cover had us nibbling our nails. Considering this range of data points, we think DCW is in a good position to manage its debt levels. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that DCW is showing 2 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DCW

DCW

Engages in the manufacture and sale of heavy chemical products in India.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives