- India

- /

- Paper and Forestry Products

- /

- NSEI:ABREL

Century Textiles and Industries (NSE:CENTURYTEX) Is Growing Earnings But Are They A Good Guide?

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. This article will consider whether Century Textiles and Industries's (NSE:CENTURYTEX) statutory profits are a good guide to its underlying earnings.

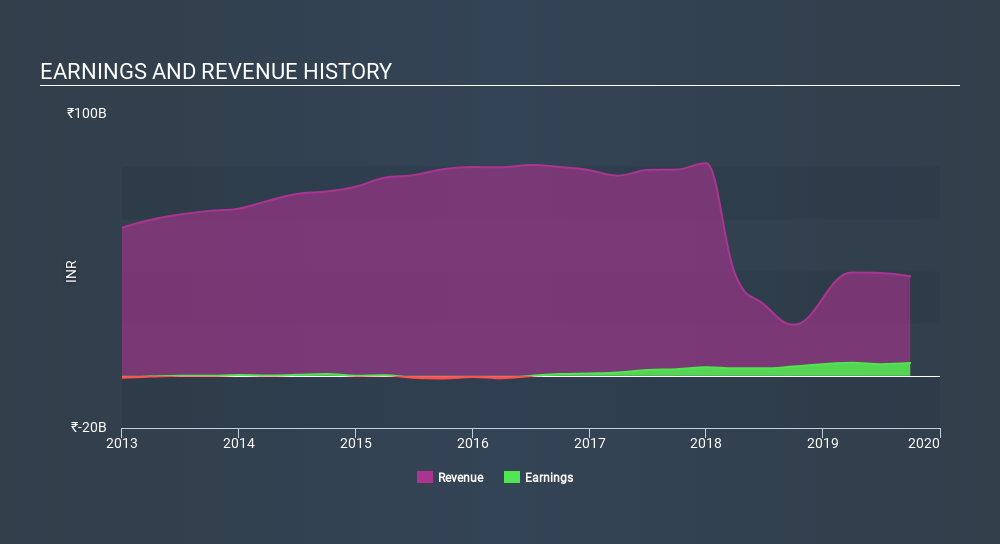

We like the fact that Century Textiles and Industries made a profit of ₹4.83b on its revenue of ₹38.0b, in the last year. As depicted below, while its revenue may have fallen over the last few years, its profit actually improved.

Check out our latest analysis for Century Textiles and Industries

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. This article will focus on the impact unusual items have had on Century Textiles and Industries's statutory earnings. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Century Textiles and Industries.

The Impact Of Unusual Items On Profit

For anyone who wants to understand Century Textiles and Industries's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit was reduced by ₹1.5b due to unusual items. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. If Century Textiles and Industries doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Our Take On Century Textiles and Industries's Profit Performance

Because unusual items detracted from Century Textiles and Industries's earnings over the last year, you could argue that we can expect an improved result in the current quarter. Based on this observation, we consider it likely that Century Textiles and Industries's statutory profit actually understates its earnings potential! And on top of that, its earnings per share have grown at an extremely impressive rate over the last three years. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. While it's very important to consider the profit and loss statement, you can also learn a lot about a company by looking at its balance sheet. If you want to,you can see our take on Century Textiles and Industries's balance sheet by clicking here.

Today we've zoomed in on a single data point to better understand the nature of Century Textiles and Industries's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:ABREL

Aditya Birla Real Estate

Develops and leases real estate properties primarily in India.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives