Carborundum Universal (NSE:CARBORUNIV) Ticks All The Boxes When It Comes To Earnings Growth

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Carborundum Universal (NSE:CARBORUNIV). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Carborundum Universal with the means to add long-term value to shareholders.

See our latest analysis for Carborundum Universal

Carborundum Universal's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Carborundum Universal has managed to grow EPS by 17% per year over three years. So it's not surprising to see the company trades on a very high multiple of (past) earnings.

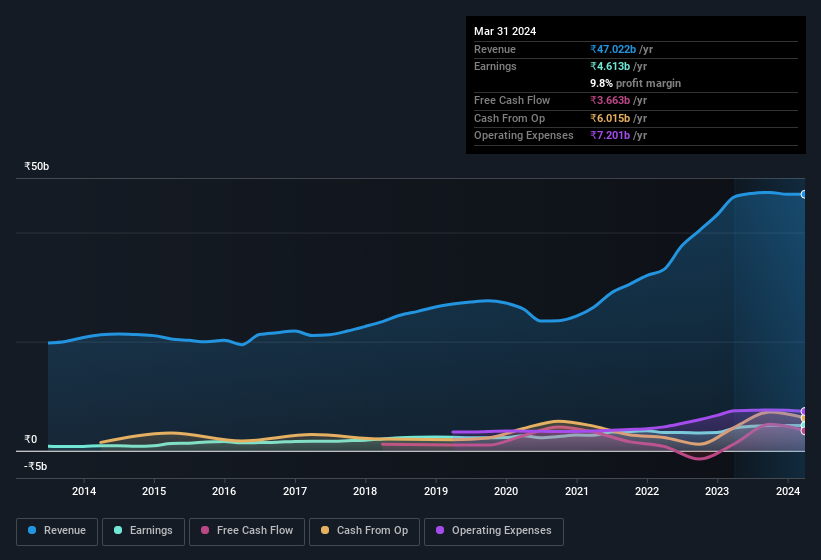

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It was a year of stability for Carborundum Universal as both revenue and EBIT margins remained have been flat over the past year. While this doesn't ring alarm bells, it may not meet the expectations of growth-minded investors.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Carborundum Universal.

Are Carborundum Universal Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Carborundum Universal followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. We note that their impressive stake in the company is worth ₹20b. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Well, based on the CEO pay, you'd argue that they are indeed. Our analysis has discovered that the median total compensation for the CEOs of companies like Carborundum Universal with market caps between ₹167b and ₹534b is about ₹47m.

Carborundum Universal offered total compensation worth ₹24m to its CEO in the year to March 2023. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Carborundum Universal Worth Keeping An Eye On?

You can't deny that Carborundum Universal has grown its earnings per share at a very impressive rate. That's attractive. If you still have your doubts, remember too that company insiders have a considerable investment aligning themselves with the shareholders and CEO pay is quite modest compared to similarly sized companiess. The overarching message here is that Carborundum Universal has underlying strengths that make it worth a look at. Another important measure of business quality not discussed here, is return on equity (ROE). Click on this link to see how Carborundum Universal shapes up to industry peers, when it comes to ROE.

Although Carborundum Universal certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Indian companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CARBORUNIV

Carborundum Universal

Manufactures and sells abrasives, ceramics, and electrominerals in India and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives