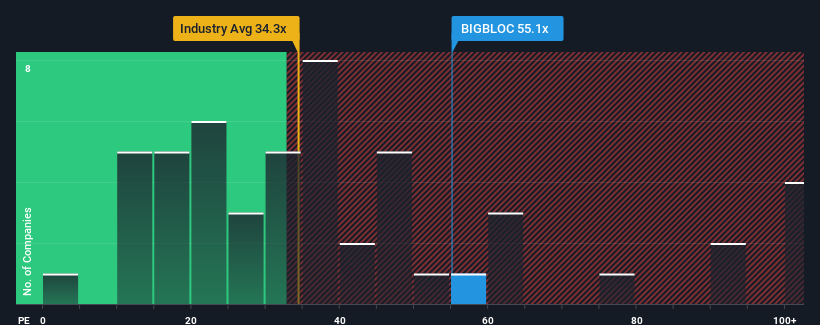

When close to half the companies in India have price-to-earnings ratios (or "P/E's") below 32x, you may consider Bigbloc Construction Limited (NSE:BIGBLOC) as a stock to avoid entirely with its 55.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Earnings have risen at a steady rate over the last year for Bigbloc Construction, which is generally not a bad outcome. It might be that many expect the reasonable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Bigbloc Construction

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Bigbloc Construction's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a decent 4.9% gain to the company's bottom line. The latest three year period has also seen an excellent 356% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is only predicted to deliver 26% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's understandable that Bigbloc Construction's P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Bottom Line On Bigbloc Construction's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Bigbloc Construction maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Bigbloc Construction (1 is potentially serious!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Bigbloc Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BIGBLOC

Bigbloc Construction

Engages in the manufacturing, sales, and marketing of aerated autoclave concrete blocks in India.

Low risk with questionable track record.

Market Insights

Community Narratives