Further Upside For Best Agrolife Limited (NSE:BESTAGRO) Shares Could Introduce Price Risks After 32% Bounce

Best Agrolife Limited (NSE:BESTAGRO) shares have had a really impressive month, gaining 32% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 41% in the last twelve months.

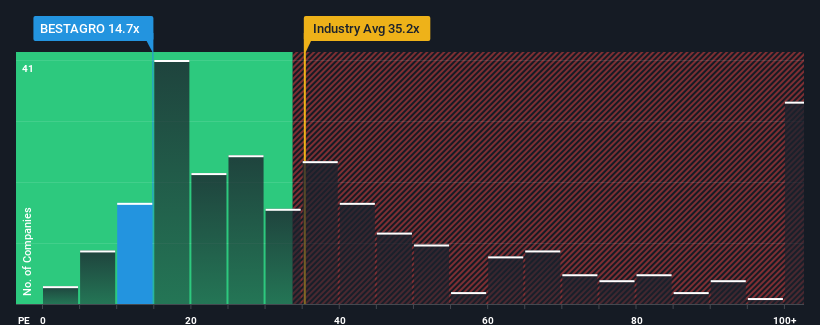

In spite of the firm bounce in price, given about half the companies in India have price-to-earnings ratios (or "P/E's") above 35x, you may still consider Best Agrolife as a highly attractive investment with its 14.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

As an illustration, earnings have deteriorated at Best Agrolife over the last year, which is not ideal at all. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Best Agrolife

Does Growth Match The Low P/E?

Best Agrolife's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 45%. Still, the latest three year period has seen an excellent 167% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Comparing that to the market, which is only predicted to deliver 25% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's peculiar that Best Agrolife's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Best Agrolife's recent share price jump still sees its P/E sitting firmly flat on the ground. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Best Agrolife revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you take the next step, you should know about the 4 warning signs for Best Agrolife (2 make us uncomfortable!) that we have uncovered.

If these risks are making you reconsider your opinion on Best Agrolife, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Best Agrolife might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:BESTAGRO

Best Agrolife

Engages in the manufacture and sale of agrochemical products in India and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives