Market Participants Recognise B&B Triplewall Containers Limited's (NSE:BBTCL) Revenues Pushing Shares 30% Higher

Those holding B&B Triplewall Containers Limited (NSE:BBTCL) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 34% in the last twelve months.

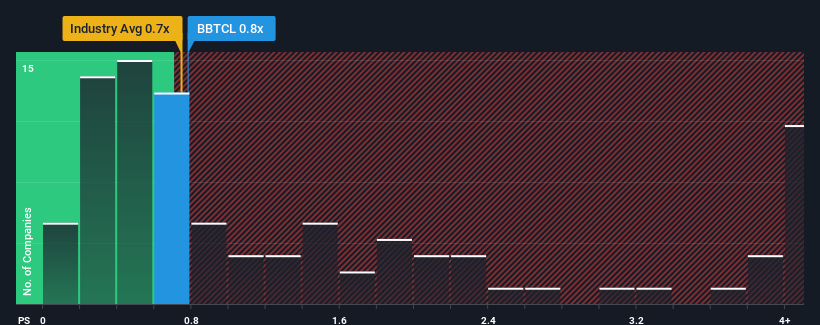

In spite of the firm bounce in price, there still wouldn't be many who think B&B Triplewall Containers' price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S in India's Packaging industry is similar at about 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for B&B Triplewall Containers

What Does B&B Triplewall Containers' Recent Performance Look Like?

B&B Triplewall Containers has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on B&B Triplewall Containers will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for B&B Triplewall Containers, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like B&B Triplewall Containers' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 28%. The strong recent performance means it was also able to grow revenue by 51% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 13% shows it's about the same on an annualised basis.

With this information, we can see why B&B Triplewall Containers is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

What Does B&B Triplewall Containers' P/S Mean For Investors?

B&B Triplewall Containers' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It appears to us that B&B Triplewall Containers maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Before you settle on your opinion, we've discovered 3 warning signs for B&B Triplewall Containers (1 is significant!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if B&B Triplewall Containers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BBTCL

B&B Triplewall Containers

Manufactures and sells corrugated boards, boxes and packaging materials.in India.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026