- India

- /

- Paper and Forestry Products

- /

- NSEI:BALLARPUR

Introducing Ballarpur Industries (NSE:BALLARPUR), The Stock That Collapsed 98%

As every investor would know, not every swing hits the sweet spot. But you have a problem if you face massive losses more than once in a while. So consider, for a moment, the misfortune of Ballarpur Industries Limited (NSE:BALLARPUR) investors who have held the stock for three years as it declined a whopping 98%. That would certainly shake our confidence in the decision to own the stock. And the ride hasn't got any smoother in recent times over the last year, with the price 89% lower in that time. Even worse, it's down 30% in about a month, which isn't fun at all. We do note, however, that the broader market is down 19% in that period, and this may have weighed on the share price.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for Ballarpur Industries

Ballarpur Industries isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over three years, Ballarpur Industries grew revenue at 22% per year. That's well above most other pre-profit companies. So why has the share priced crashed 74% per year, in the same time? You'd want to take a close look at the balance sheet, as well as the losses. Sometimes fast revenue growth doesn't lead to profits. Unless the balance sheet is strong, the company might have to raise capital.

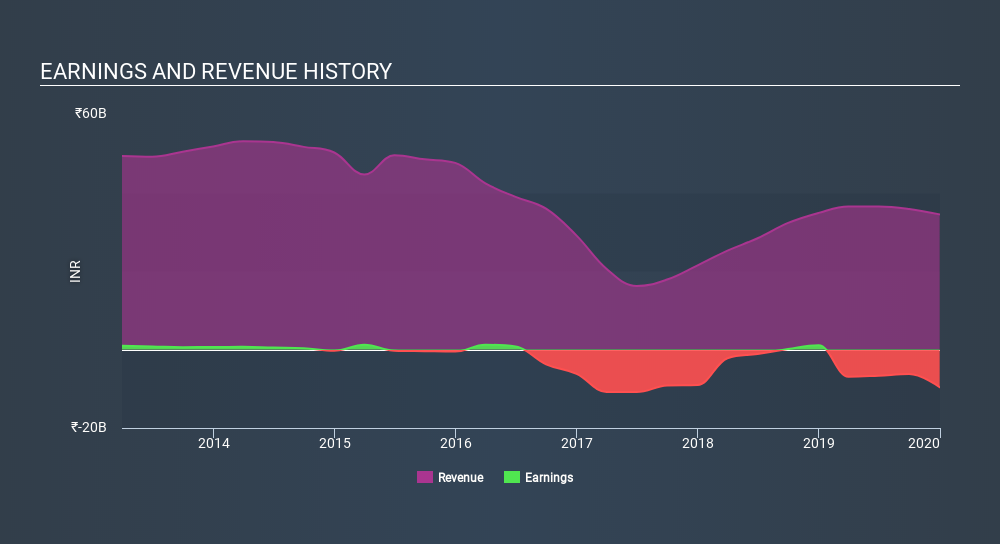

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Ballarpur Industries's financial health with this free report on its balance sheet.

A Different Perspective

We regret to report that Ballarpur Industries shareholders are down 89% for the year. Unfortunately, that's worse than the broader market decline of 14%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 52% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Ballarpur Industries (at least 2 which are a bit unpleasant) , and understanding them should be part of your investment process.

We will like Ballarpur Industries better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:BALLARPUR

Ballarpur Industries

Ballarpur Industries Limited, together with its subsidiaries, manufactures, sells, and exports writing and printing paper, and pulp products in India and internationally.

Weak fundamentals or lack of information.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success