The Market Lifts Arrow Greentech Limited (NSE:ARROWGREEN) Shares 27% But It Can Do More

Arrow Greentech Limited (NSE:ARROWGREEN) shares have continued their recent momentum with a 27% gain in the last month alone. The last month tops off a massive increase of 112% in the last year.

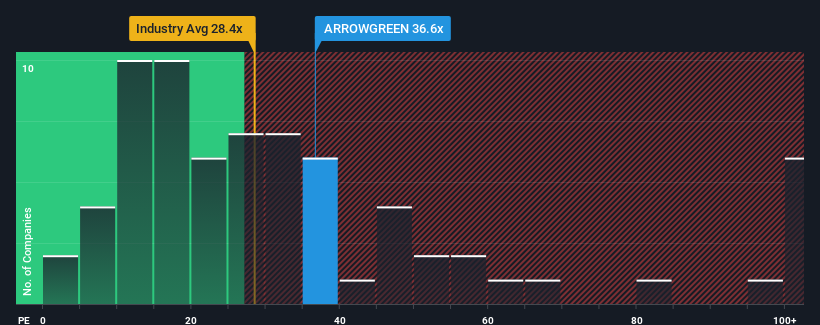

In spite of the firm bounce in price, there still wouldn't be many who think Arrow Greentech's price-to-earnings (or "P/E") ratio of 36.6x is worth a mention when the median P/E in India is similar at about 35x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings growth that's exceedingly strong of late, Arrow Greentech has been doing very well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Arrow Greentech

Is There Some Growth For Arrow Greentech?

In order to justify its P/E ratio, Arrow Greentech would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 130% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 330% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 26% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Arrow Greentech's P/E sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

Arrow Greentech appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Arrow Greentech currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Arrow Greentech (of which 2 make us uncomfortable!) you should know about.

If these risks are making you reconsider your opinion on Arrow Greentech, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ARROWGREEN

Arrow Greentech

Engages in the manufacture and sale of water-soluble films, bio-compostable products, and other green products in India and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives