Arrow Greentech Limited (NSE:ARROWGREEN) Looks Like A Good Stock, And It's Going Ex-Dividend Soon

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Arrow Greentech Limited (NSE:ARROWGREEN) is about to go ex-dividend in just 4 days. The ex-dividend date is two business days before a company's record date in most cases, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade can take two business days or more to settle. Accordingly, Arrow Greentech investors that purchase the stock on or after the 18th of September will not receive the dividend, which will be paid on the 22nd of October.

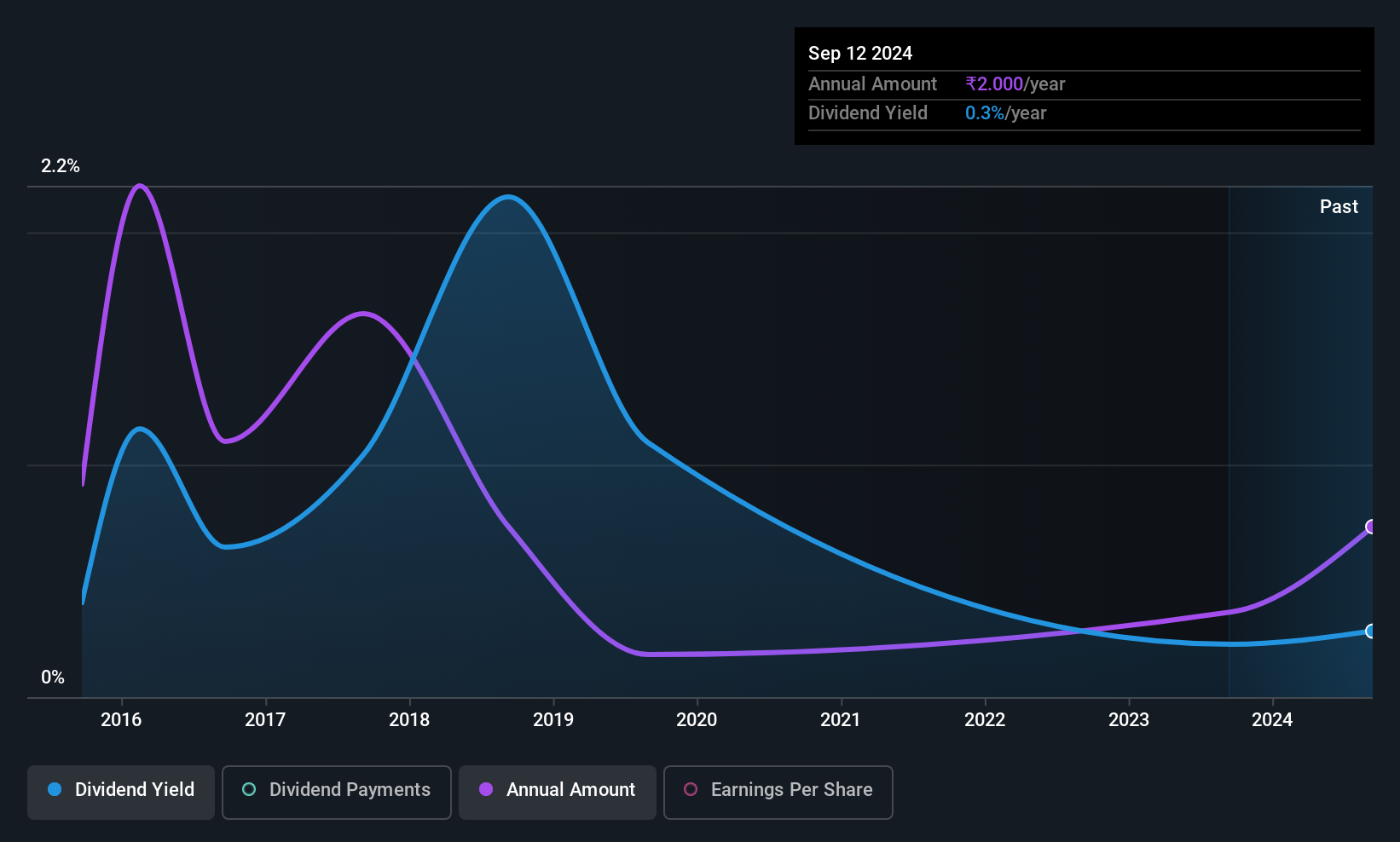

The company's upcoming dividend is ₹4.00 a share, following on from the last 12 months, when the company distributed a total of ₹4.00 per share to shareholders. Based on the last year's worth of payments, Arrow Greentech has a trailing yield of 0.7% on the current stock price of ₹566.45. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! As a result, readers should always check whether Arrow Greentech has been able to grow its dividends, or if the dividend might be cut.

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Arrow Greentech paid out just 9.6% of its profit last year, which we think is conservatively low and leaves plenty of margin for unexpected circumstances. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. The good news is it paid out just 5.2% of its free cash flow in the last year.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

View our latest analysis for Arrow Greentech

Click here to see how much of its profit Arrow Greentech paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. It's encouraging to see Arrow Greentech has grown its earnings rapidly, up 62% a year for the past five years. Arrow Greentech looks like a real growth company, with earnings per share growing at a cracking pace and the company reinvesting most of its profits in the business.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the past 10 years, Arrow Greentech has increased its dividend at approximately 4.8% a year on average. Earnings per share have been growing much quicker than dividends, potentially because Arrow Greentech is keeping back more of its profits to grow the business.

To Sum It Up

Is Arrow Greentech worth buying for its dividend? It's great that Arrow Greentech is growing earnings per share while simultaneously paying out a low percentage of both its earnings and cash flow. It's disappointing to see the dividend has been cut at least once in the past, but as things stand now, the low payout ratio suggests a conservative approach to dividends, which we like. Arrow Greentech looks solid on this analysis overall, and we'd definitely consider investigating it more closely.

In light of that, while Arrow Greentech has an appealing dividend, it's worth knowing the risks involved with this stock. To that end, you should learn about the 3 warning signs we've spotted with Arrow Greentech (including 1 which is potentially serious).

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ARROWGREEN

Arrow Greentech

Engages in the manufacture and sale of water-soluble films, bio-compostable products, and other green products in India and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion