Here's Why Shareholders May Want To Be Cautious With Increasing Apcotex Industries Limited's (NSE:APCOTEXIND) CEO Pay Packet

Key Insights

- Apcotex Industries will host its Annual General Meeting on 26th of June

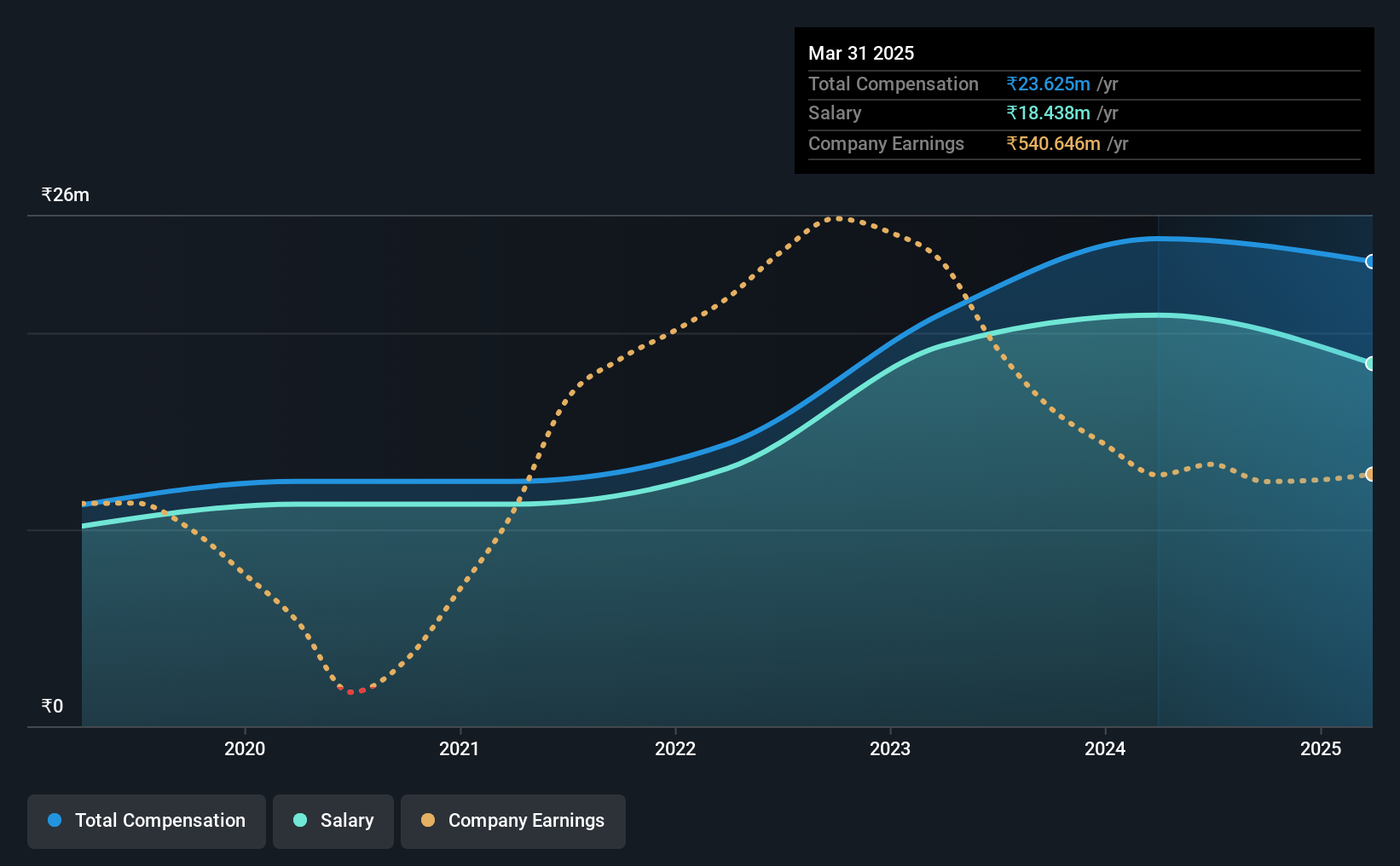

- Total pay for CEO Abhiraj Choksey includes ₹18.4m salary

- Total compensation is 34% above industry average

- Over the past three years, Apcotex Industries' EPS fell by 18% and over the past three years, the total loss to shareholders 32%

The underwhelming share price performance of Apcotex Industries Limited (NSE:APCOTEXIND) in the past three years would have disappointed many shareholders. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. In light of this performance, shareholders will have a chance to question the board in the upcoming AGM on 26th of June, where they can impact on future company performance by voting on resolutions, including executive compensation. Here's our take on why we think shareholders might be hesitant about approving a raise at the moment.

Check out our latest analysis for Apcotex Industries

Comparing Apcotex Industries Limited's CEO Compensation With The Industry

At the time of writing, our data shows that Apcotex Industries Limited has a market capitalization of ₹20b, and reported total annual CEO compensation of ₹24m for the year to March 2025. That's a slight decrease of 4.7% on the prior year. We note that the salary portion, which stands at ₹18.4m constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the Indian Chemicals industry with market capitalizations ranging from ₹8.7b to ₹35b, the reported median CEO total compensation was ₹18m. Accordingly, our analysis reveals that Apcotex Industries Limited pays Abhiraj Choksey north of the industry median. What's more, Abhiraj Choksey holds ₹2.8b worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | ₹18m | ₹21m | 78% |

| Other | ₹5.2m | ₹3.9m | 22% |

| Total Compensation | ₹24m | ₹25m | 100% |

Talking in terms of the industry, salary represented approximately 89% of total compensation out of all the companies we analyzed, while other remuneration made up 11% of the pie. In Apcotex Industries' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Apcotex Industries Limited's Growth Numbers

Apcotex Industries Limited has reduced its earnings per share by 18% a year over the last three years. It achieved revenue growth of 24% over the last year.

The decrease in EPS could be a concern for some investors. But on the other hand, revenue growth is strong, suggesting a brighter future. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Apcotex Industries Limited Been A Good Investment?

The return of -32% over three years would not have pleased Apcotex Industries Limited shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

The company's earnings haven't grown and possibly because of that, the stock has performed poorly, resulting in a loss for the company's shareholders. Shareholders will get the chance at the upcoming AGM to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 1 warning sign for Apcotex Industries that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:APCOTEXIND

Apcotex Industries

Produces and sells synthetic emulsion polymers in India and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion