David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Ambuja Cements Limited (NSE:AMBUJACEM) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Ambuja Cements

How Much Debt Does Ambuja Cements Carry?

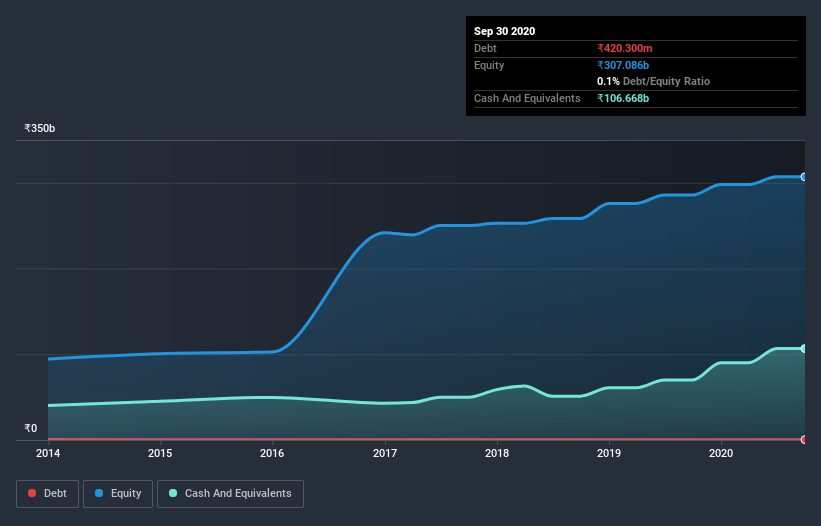

As you can see below, at the end of June 2020, Ambuja Cements had ₹420.3m of debt, up from ₹339.9m a year ago. Click the image for more detail. But it also has ₹106.7b in cash to offset that, meaning it has ₹106.2b net cash.

A Look At Ambuja Cements's Liabilities

We can see from the most recent balance sheet that Ambuja Cements had liabilities of ₹88.9b falling due within a year, and liabilities of ₹16.7b due beyond that. Offsetting this, it had ₹106.7b in cash and ₹9.51b in receivables that were due within 12 months. So it actually has ₹10.6b more liquid assets than total liabilities.

This surplus suggests that Ambuja Cements has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Ambuja Cements boasts net cash, so it's fair to say it does not have a heavy debt load!

Also good is that Ambuja Cements grew its EBIT at 10% over the last year, further increasing its ability to manage debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Ambuja Cements can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Ambuja Cements may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last three years, Ambuja Cements produced sturdy free cash flow equating to 73% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Summing up

While it is always sensible to investigate a company's debt, in this case Ambuja Cements has ₹106.2b in net cash and a decent-looking balance sheet. The cherry on top was that in converted 73% of that EBIT to free cash flow, bringing in ₹37b. So we don't think Ambuja Cements's use of debt is risky. Another factor that would give us confidence in Ambuja Cements would be if insiders have been buying shares: if you're conscious of that signal too, you can find out instantly by clicking this link.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade Ambuja Cements, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:AMBUJACEM

Ambuja Cements

Manufactures, markets, and sells cement and related products to individual homebuilders, developers, infrastructure projects, masons and contractors, professionals, and architects and engineers in India.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives