In the midst of a busy earnings season, global markets have seen mixed results, with small-cap stocks showing resilience compared to their larger counterparts. As economic indicators send varied signals, particularly in the labor and manufacturing sectors, investors are increasingly looking towards small-cap companies that demonstrate robust fundamentals and adaptability in uncertain times. Identifying promising small caps involves assessing factors such as financial health, growth potential, and market positioning—qualities that can offer opportunities even when broader market sentiment is cautious.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Forth Smart Service | 21.94% | -8.16% | -16.02% | ★★★★★★ |

| SHL Consolidated Bhd | NA | 15.25% | 15.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| IFE Elevators | NA | 12.67% | 17.10% | ★★★★★★ |

| Jinghua Pharmaceutical Group | 0.90% | 5.39% | 47.06% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Poly Plastic Masterbatch (SuZhou)Ltd | 2.80% | 17.08% | -4.11% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Advanced Enzyme Technologies (NSEI:ADVENZYMES)

Simply Wall St Value Rating: ★★★★★★

Overview: Advanced Enzyme Technologies Limited, along with its subsidiaries, focuses on the research, development, manufacture, and marketing of enzymes and probiotics across India, Europe, the United States, Asia, and other international markets with a market capitalization of ₹53.51 billion.

Operations: Advanced Enzyme Technologies generates revenue primarily from the manufacturing and sales of enzymes, amounting to ₹6.31 billion.

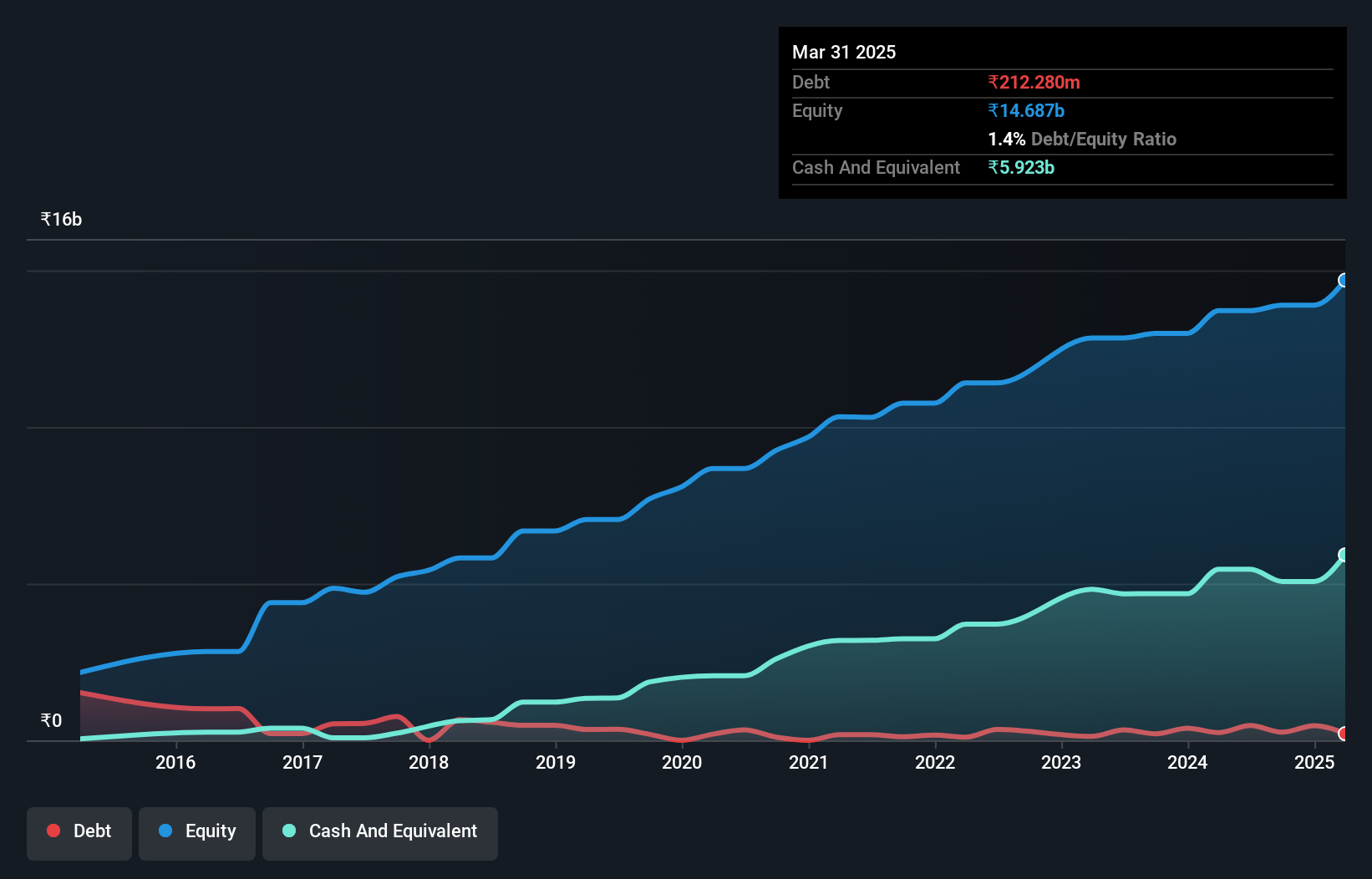

Advanced Enzyme Technologies, a smaller player in the chemicals sector, has shown robust earnings growth of 18.9% over the past year, outpacing the industry average of 10.4%. The company reported first-quarter sales of INR 1,545 million and net income rose to INR 341 million from INR 288 million a year ago. Despite facing a tax penalty for under-reported R&D expenses, it seems this hasn't materially impacted its financial health or operations. Debt management appears strong with a reduced debt-to-equity ratio from 5% to 3.5% over five years and more cash than total debt on hand.

Haitong Unitrust International Financial Leasing (SEHK:1905)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Haitong Unitrust International Financial Leasing Co., Ltd. operates as a financial leasing company in the People’s Republic of China with a market capitalization of HK$6.75 billion.

Operations: Haitong Unitrust generates revenue primarily from financial leasing activities in China. The company's net profit margin is a key indicator of its profitability.

Haitong Unitrust, a financial leasing firm, is navigating its way through the market with notable characteristics. The company's net debt to equity ratio stands at 160%, reflecting high leverage, yet it has successfully reduced this from 403% over five years. Despite this leverage, Haitong Unitrust's earnings grew by 0.5% last year, surpassing the industry average of -6.6%. Recent earnings reveal a net income of CNY 1.25 billion for nine months ending September 2024, slightly up from CNY 1.21 billion previously. Trading at nearly 69% below estimated fair value suggests potential undervaluation in the market context.

Taiwan Secom (TWSE:9917)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Taiwan Secom Co., Ltd. offers security services in Taiwan and has a market capitalization of NT$61.63 billion.

Operations: The company's primary revenue streams include the Electronic Systems Department, contributing NT$7.53 billion, and the Other Business Department, generating NT$4.83 billion. Additional income is derived from the Stay in Security Department and Restaurant Services, with revenues of NT$2.61 billion and NT$1.78 billion respectively.

Taiwan Secom, a promising player in the security services sector, has shown notable financial resilience. Its earnings growth of 7.2% over the past year outpaced the industry average of 3.1%, indicating robust performance. The company reported net income for Q2 2024 at TWD 788.96 million compared to TWD 643.12 million a year ago, with basic earnings per share rising to TWD 1.78 from TWD 1.46 previously, reflecting solid profitability improvements. Despite an increase in its debt-to-equity ratio from 31% to nearly 44% over five years, Taiwan Secom's interest coverage is strong at an impressive EBIT multiple of 33x, underscoring financial health and operational efficiency.

- Click here and access our complete health analysis report to understand the dynamics of Taiwan Secom.

Explore historical data to track Taiwan Secom's performance over time in our Past section.

Taking Advantage

- Click here to access our complete index of 4741 Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ADVENZYMES

Advanced Enzyme Technologies

Engages in the research, development, manufacture, and marketing of enzymes and probiotics in India, Europe, the United States, Asia, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives