Earnings Troubles May Signal Larger Issues for Aarti Surfactants (NSE:AARTISURF) Shareholders

Last week's earnings announcement from Aarti Surfactants Limited (NSE:AARTISURF) was disappointing to investors, with a sluggish profit figure. We did some further digging and think they have a few more reasons to be concerned beyond the statutory profit.

Check out our latest analysis for Aarti Surfactants

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, Aarti Surfactants issued 6.7% more new shares over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Aarti Surfactants' historical EPS growth by clicking on this link.

A Look At The Impact Of Aarti Surfactants' Dilution On Its Earnings Per Share (EPS)

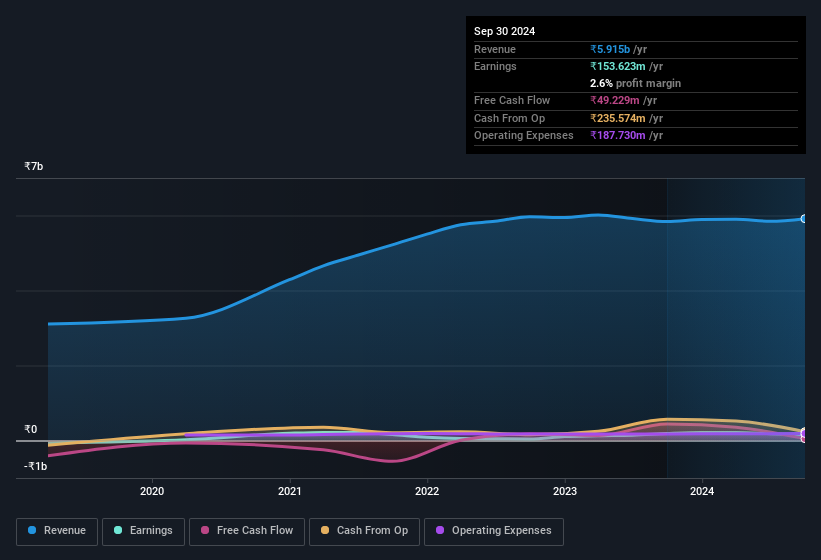

Aarti Surfactants' net profit dropped by 2.9% per year over the last three years. And even focusing only on the last twelve months, we see profit is down 18%. Sadly, earnings per share fell further, down a full 22% in that time. And so, you can see quite clearly that dilution is influencing shareholder earnings.

If Aarti Surfactants' EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Aarti Surfactants.

How Do Unusual Items Influence Profit?

Finally, we should also consider the fact that unusual items boosted Aarti Surfactants' net profit by ₹42m over the last year. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. Which is hardly surprising, given the name. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On Aarti Surfactants' Profit Performance

In its last report Aarti Surfactants benefitted from unusual items which boosted its profit, which could make the profit seem better than it really is on a sustainable basis. On top of that, the dilution means that its earnings per share performance is worse than its profit performance. Considering all this we'd argue Aarti Surfactants' profits probably give an overly generous impression of its sustainable level of profitability. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. Case in point: We've spotted 5 warning signs for Aarti Surfactants you should be mindful of and 1 of them is potentially serious.

Our examination of Aarti Surfactants has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AARTISURF

Aarti Surfactants

Together with its subsidiary, produces and supplies ionic and non-ionic surfactants, and specialty products for the home and personal care, agro and oil, and industrial applications in India and internationally.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives