ICICI Lombard General Insurance Company Limited (NSE:ICICIGI) Looks Like A Good Stock, And It's Going Ex-Dividend Soon

ICICI Lombard General Insurance Company Limited (NSE:ICICIGI) is about to trade ex-dividend in the next 3 days. Investors can purchase shares before the 18th of March in order to be eligible for this dividend, which will be paid on the 4th of April.

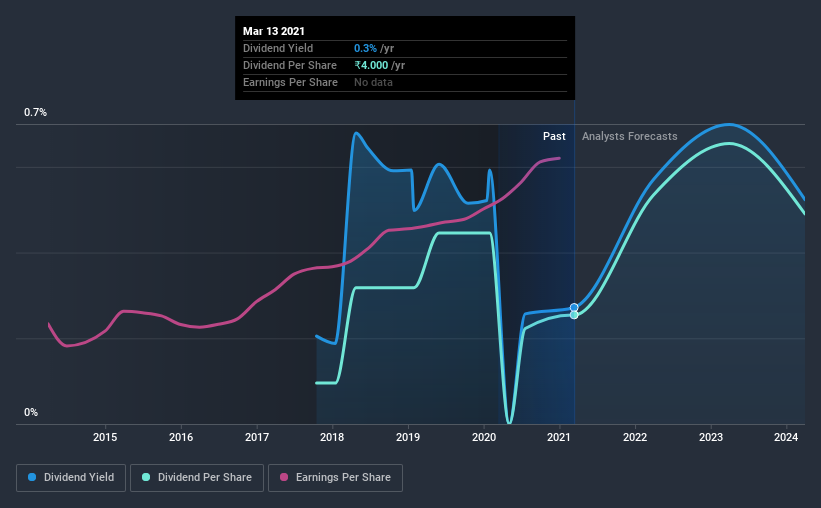

ICICI Lombard General Insurance's next dividend payment will be ₹4.00 per share. Last year, in total, the company distributed ₹4.00 to shareholders. Calculating the last year's worth of payments shows that ICICI Lombard General Insurance has a trailing yield of 0.3% on the current share price of ₹1471.2. If you buy this business for its dividend, you should have an idea of whether ICICI Lombard General Insurance's dividend is reliable and sustainable. As a result, readers should always check whether ICICI Lombard General Insurance has been able to grow its dividends, or if the dividend might be cut.

View our latest analysis for ICICI Lombard General Insurance

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. ICICI Lombard General Insurance has a low and conservative payout ratio of just 13% of its income after tax.

Companies that pay out less in dividends than they earn in profits generally have more sustainable dividends. The lower the payout ratio, the more wiggle room the business has before it could be forced to cut the dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Fortunately for readers, ICICI Lombard General Insurance's earnings per share have been growing at 19% a year for the past five years.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the past three years, ICICI Lombard General Insurance has increased its dividend at approximately 39% a year on average. It's great to see earnings per share growing rapidly over several years, and dividends per share growing right along with it.

The Bottom Line

Should investors buy ICICI Lombard General Insurance for the upcoming dividend? Typically, companies that are growing rapidly and paying out a low fraction of earnings are keeping the profits for reinvestment in the business. Perhaps even more importantly - this can sometimes signal management is focused on the long term future of the business. We think this is a pretty attractive combination, and would be interested in investigating ICICI Lombard General Insurance more closely.

On that note, you'll want to research what risks ICICI Lombard General Insurance is facing. For example, we've found 1 warning sign for ICICI Lombard General Insurance that we recommend you consider before investing in the business.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade ICICI Lombard General Insurance, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:ICICIGI

ICICI Lombard General Insurance

Provides various general insurance products and services in India.

Solid track record with excellent balance sheet.