- India

- /

- Personal Products

- /

- NSEI:HINDUNILVR

Risks To Shareholder Returns Are Elevated At These Prices For Hindustan Unilever Limited (NSE:HINDUNILVR)

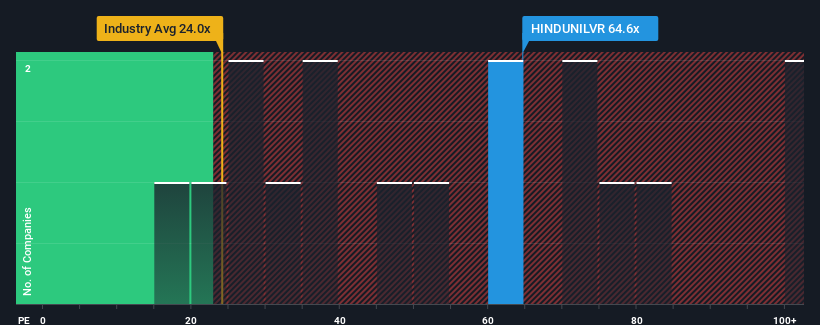

Hindustan Unilever Limited's (NSE:HINDUNILVR) price-to-earnings (or "P/E") ratio of 64.6x might make it look like a strong sell right now compared to the market in India, where around half of the companies have P/E ratios below 34x and even P/E's below 19x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Hindustan Unilever could be doing better as it's been growing earnings less than most other companies lately. One possibility is that the P/E is high because investors think this lacklustre earnings performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Hindustan Unilever

Does Growth Match The High P/E?

Hindustan Unilever's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period was better as it's delivered a decent 26% overall rise in EPS. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 10% per annum over the next three years. With the market predicted to deliver 20% growth per year, the company is positioned for a weaker earnings result.

With this information, we find it concerning that Hindustan Unilever is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Hindustan Unilever currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 1 warning sign for Hindustan Unilever you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Hindustan Unilever might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HINDUNILVR

Hindustan Unilever

A consumer good company, manufactures and sells food, home care, personal care, and refreshment products in India and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives