- India

- /

- Personal Products

- /

- NSEI:BAJAJCON

There Is A Reason Bajaj Consumer Care Limited's (NSE:BAJAJCON) Price Is Undemanding

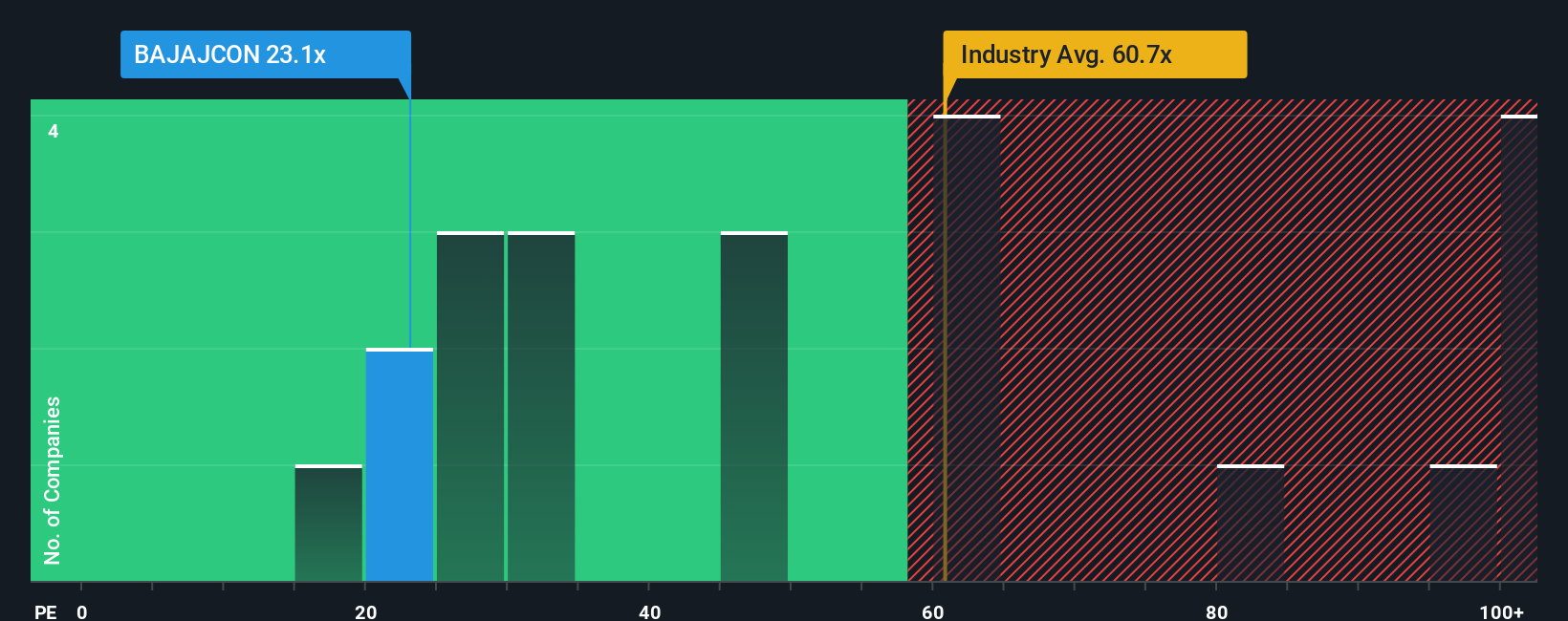

When close to half the companies in India have price-to-earnings ratios (or "P/E's") above 29x, you may consider Bajaj Consumer Care Limited (NSE:BAJAJCON) as an attractive investment with its 23.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

While the market has experienced earnings growth lately, Bajaj Consumer Care's earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Bajaj Consumer Care

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Bajaj Consumer Care would need to produce sluggish growth that's trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 17%. This means it has also seen a slide in earnings over the longer-term as EPS is down 24% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 13% each year as estimated by the four analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 22% each year, which is noticeably more attractive.

In light of this, it's understandable that Bajaj Consumer Care's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Bajaj Consumer Care's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Bajaj Consumer Care's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware Bajaj Consumer Care is showing 1 warning sign in our investment analysis, you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Bajaj Consumer Care might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BAJAJCON

Bajaj Consumer Care

Manufactures and sells cosmetics, toiletries, and other personal care products in India and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives