- India

- /

- Healthcare Services

- /

- NSEI:LALPATHLAB

Is Dr. Lal PathLabs Limited's (NSE:LALPATHLAB) Stock's Recent Performance Being Led By Its Attractive Financial Prospects?

Dr. Lal PathLabs' (NSE:LALPATHLAB) stock is up by a considerable 18% over the past three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. Specifically, we decided to study Dr. Lal PathLabs' ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Our free stock report includes 2 warning signs investors should be aware of before investing in Dr. Lal PathLabs. Read for free now.How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Dr. Lal PathLabs is:

22% = ₹4.9b ÷ ₹22b (Based on the trailing twelve months to March 2025).

The 'return' is the yearly profit. Another way to think of that is that for every ₹1 worth of equity, the company was able to earn ₹0.22 in profit.

View our latest analysis for Dr. Lal PathLabs

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Dr. Lal PathLabs' Earnings Growth And 22% ROE

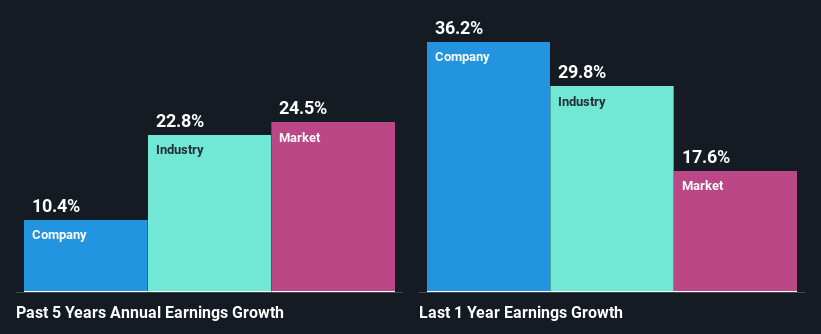

To start with, Dr. Lal PathLabs' ROE looks acceptable. Further, the company's ROE compares quite favorably to the industry average of 12%. Probably as a result of this, Dr. Lal PathLabs was able to see a decent growth of 10% over the last five years.

Next, on comparing with the industry net income growth, we found that Dr. Lal PathLabs' reported growth was lower than the industry growth of 23% over the last few years, which is not something we like to see.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Dr. Lal PathLabs fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Dr. Lal PathLabs Using Its Retained Earnings Effectively?

With a three-year median payout ratio of 41% (implying that the company retains 59% of its profits), it seems that Dr. Lal PathLabs is reinvesting efficiently in a way that it sees respectable amount growth in its earnings and pays a dividend that's well covered.

Besides, Dr. Lal PathLabs has been paying dividends over a period of nine years. This shows that the company is committed to sharing profits with its shareholders. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 40%. Therefore, the company's future ROE is also not expected to change by much with analysts predicting an ROE of 22%.

Conclusion

On the whole, we feel that Dr. Lal PathLabs' performance has been quite good. In particular, it's great to see that the company is investing heavily into its business and along with a high rate of return, that has resulted in a respectable growth in its earnings. We also studied the latest analyst forecasts and found that the company's earnings growth is expected be similar to its current growth rate. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LALPATHLAB

Dr. Lal PathLabs

Operates laboratories for carrying out pathological investigations in India and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion