- Brazil

- /

- Oil and Gas

- /

- BOVESPA:CSAN3

3 Growth Companies With High Insider Ownership And 24% Earnings Growth

Reviewed by Simply Wall St

In a week marked by downside economic surprises and a sharp pullback in major benchmarks, investors are increasingly looking for resilient growth opportunities. Amidst this backdrop, companies with high insider ownership and robust earnings growth often stand out as attractive options due to their potential for strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Vow (OB:VOW) | 31.7% | 97.7% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Cosan (BOVESPA:CSAN3)

Simply Wall St Growth Rating: ★★★★★☆

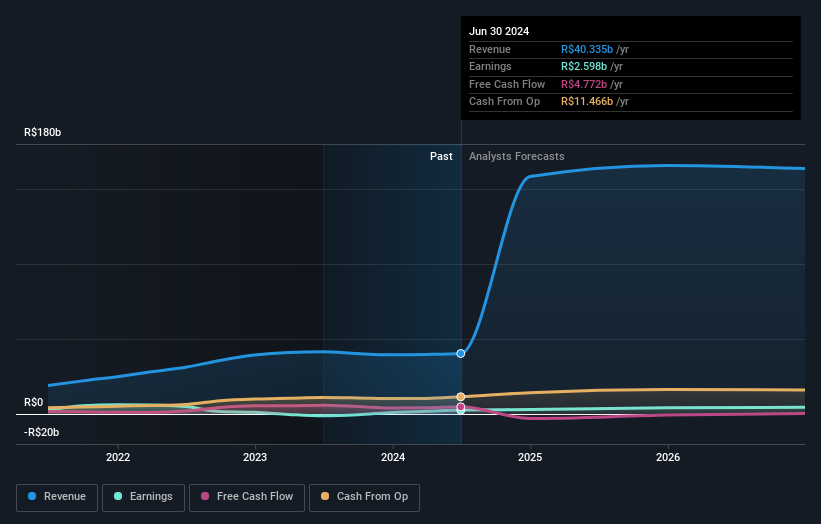

Overview: Cosan S.A. operates in the fuel distribution business with a market capitalization of R$24.59 billion.

Operations: Cosan's revenue segments include Rumo (R$11.70 billion), Moove (R$9.93 billion), Radar (R$743.21 million), Compass (R$17.38 billion), and Raízen (R$220.40 billion).

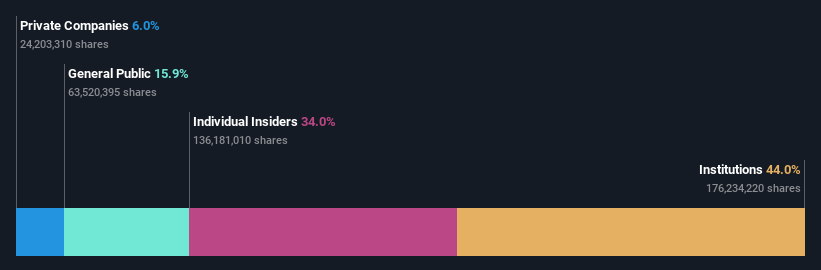

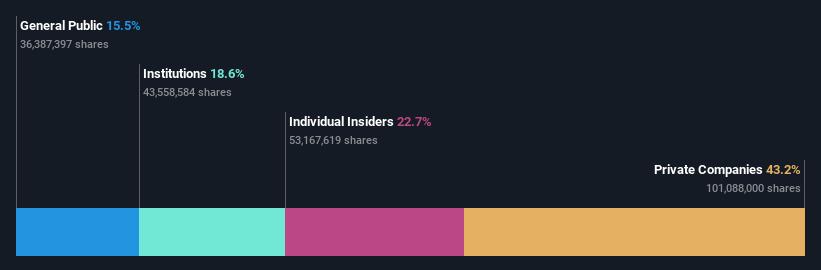

Insider Ownership: 30.2%

Earnings Growth Forecast: 24.7% p.a.

Cosan has shown strong growth potential with revenue forecasted to grow 31.7% per year, significantly outpacing the Brazilian market's 7.5%. Earnings are also expected to increase by 24.68% annually, reflecting robust profitability prospects despite a recent net loss of BRL 192.18 million in Q1 2024. However, its debt coverage by operating cash flow is concerning and the dividend track record remains unstable.

- Dive into the specifics of Cosan here with our thorough growth forecast report.

- According our valuation report, there's an indication that Cosan's share price might be on the expensive side.

Krishna Institute of Medical Sciences (NSEI:KIMS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Krishna Institute of Medical Sciences Limited offers medical and healthcare services under the KIMS Hospitals brand in India, with a market cap of ₹171.31 billion.

Operations: Krishna Institute of Medical Sciences Limited generates revenue from providing medical and healthcare services under the KIMS Hospitals brand in India.

Insider Ownership: 34%

Earnings Growth Forecast: 20.1% p.a.

Krishna Institute of Medical Sciences (KIMS) demonstrates solid growth potential with revenue expected to grow 19.3% annually, outpacing the Indian market's 9.9%. Recent Q1 earnings reported revenue of INR 6,930 million and net income of INR 866 million, reflecting consistent year-over-year growth. Although KIMS carries a high level of debt, its earnings are forecasted to grow significantly at over 20% per year, surpassing the broader market's expectations.

- Click to explore a detailed breakdown of our findings in Krishna Institute of Medical Sciences' earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Krishna Institute of Medical Sciences shares in the market.

Sirio Pharma (SZSE:300791)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sirio Pharma Co., Ltd. operates as a contract manufacturer for the dietary supplement industry worldwide and has a market cap of CN¥5.44 billion.

Operations: Sirio Pharma's revenue from Vitamins & Nutrition Products stands at CN¥3.83 billion.

Insider Ownership: 24.6%

Earnings Growth Forecast: 22.1% p.a.

Sirio Pharma exhibits strong growth potential with earnings forecasted to grow 22.11% annually, outpacing the Chinese market's 22.1%. Its recent amendments to the articles of association and executive appointments reflect active corporate governance. Despite a relatively low Return on Equity forecast (17.3%), Sirio Pharma trades at a favorable P/E ratio of 18.2x compared to the market's 27.8x, indicating good value relative to peers and industry standards.

- Take a closer look at Sirio Pharma's potential here in our earnings growth report.

- Our valuation report here indicates Sirio Pharma may be undervalued.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1471 Fast Growing Companies With High Insider Ownership by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BOVESPA:CSAN3

Good value with reasonable growth potential.