- India

- /

- Healthcare Services

- /

- NSEI:INDRAMEDCO

Indraprastha Medical Corporation Limited's (NSE:INDRAMEDCO) Stock Is Going Strong: Is the Market Following Fundamentals?

Most readers would already be aware that Indraprastha Medical's (NSE:INDRAMEDCO) stock increased significantly by 25% over the past three months. Since the market usually pay for a company’s long-term fundamentals, we decided to study the company’s key performance indicators to see if they could be influencing the market. In this article, we decided to focus on Indraprastha Medical's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for Indraprastha Medical

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Indraprastha Medical is:

27% = ₹1.1b ÷ ₹4.1b (Based on the trailing twelve months to December 2023).

The 'return' is the income the business earned over the last year. So, this means that for every ₹1 of its shareholder's investments, the company generates a profit of ₹0.27.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Indraprastha Medical's Earnings Growth And 27% ROE

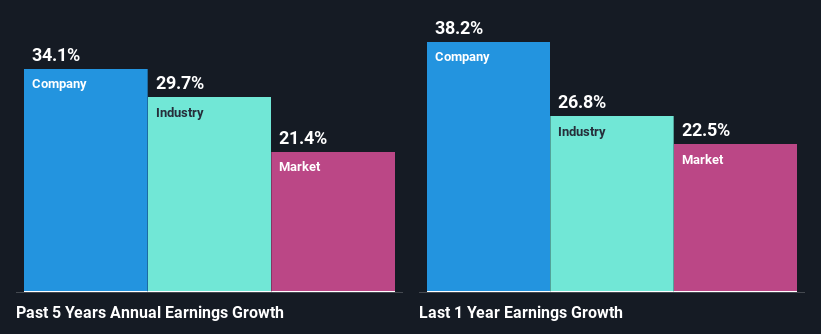

To begin with, Indraprastha Medical has a pretty high ROE which is interesting. Additionally, the company's ROE is higher compared to the industry average of 12% which is quite remarkable. Under the circumstances, Indraprastha Medical's considerable five year net income growth of 34% was to be expected.

Next, on comparing Indraprastha Medical's net income growth with the industry, we found that the company's reported growth is similar to the industry average growth rate of 30% over the last few years.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Indraprastha Medical fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Indraprastha Medical Efficiently Re-investing Its Profits?

Indraprastha Medical has a three-year median payout ratio of 36% (where it is retaining 64% of its income) which is not too low or not too high. This suggests that its dividend is well covered, and given the high growth we discussed above, it looks like Indraprastha Medical is reinvesting its earnings efficiently.

Additionally, Indraprastha Medical has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders.

Conclusion

On the whole, we feel that Indraprastha Medical's performance has been quite good. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Not to forget, share price outcomes are also dependent on the potential risks a company may face. So it is important for investors to be aware of the risks involved in the business. Our risks dashboard would have the 2 risks we have identified for Indraprastha Medical.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INDRAMEDCO

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives